- Main event: U.S. tariffs spark major market adjustments in cryptocurrencies.

- Concise takeaway: Market volatility intensified after tariff announcement.

- Additional critical impact: Federal Reserve’s interest rate decision pressures crypto prices.

Market expectations for a Federal Reserve rate cut have increased following a weak jobs report, while new U.S. tariffs will be implemented on August 7.

These developments could spur heightened volatility across global markets, impacting cryptocurrency prices significantly, as evidenced by recent liquidations and market price drops.

U.S. Tariffs and Fed Decision Boost Market Volatility

The U.S. government’s recent announcement of new tariffs, notably punitive ones on nations like Switzerland and India, has increased market volatility. Expectations for a Federal Reserve rate cut have surged significantly following a weak jobs report. Jerome Powell, Chair of the U.S. Federal Reserve, underscored ongoing economic uncertainties:

Market analysts are closely observing evolving developments, expecting shifts in liquidity conditions ahead of the tariff enactment date.

“There is still plenty and plenty of uncertainty to work through. Yes, we are indeed getting more data all the time. But it feels a ways away right now, the end of that process.”

Tariff History Shows Potential for Crypto Market Stress

Did you know? Previous tariff implementations from 2018 to 2019 led to increased market volatility and deleveraging in both crypto and traditional equity markets. Similar dynamic fluctuations are anticipated as new global tariffs take effect.

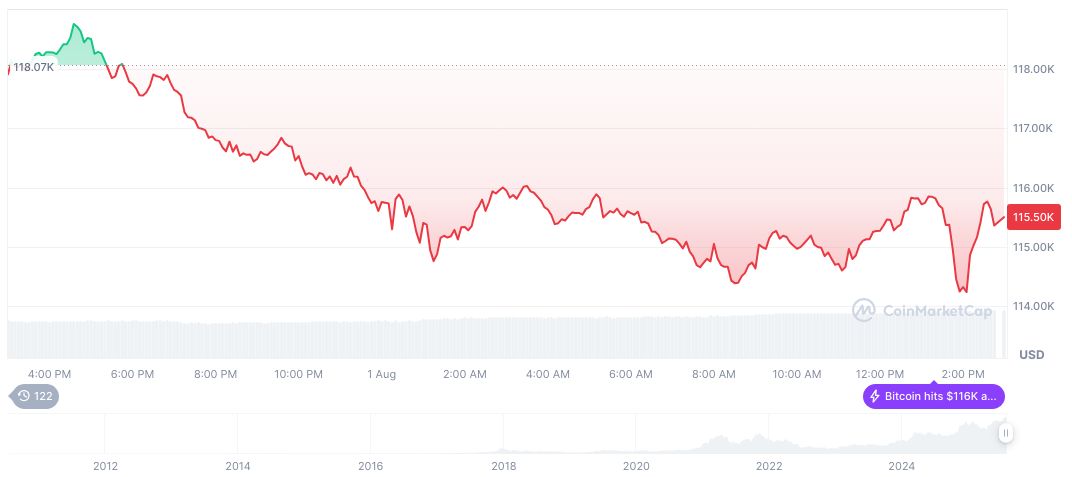

Ali charts highlights the latest in cryptocurrency prices. Bitcoin (BTC) currently trades at $113,597.37, marking a 1.23% decrease over the past 24 hours, with market dominance standing at 61.41%, according to CoinMarketCap. Its market cap is now valued at 2.26 trillion dollars. There’s been a 3.57% decrease in the past week, counteracted by a 3.47% rise over the past 30 days.

Financial experts see these macroeconomic shocks contributing to substantial market stress, particularly within crypto ecosystems. Coincu’s analysis suggests that ongoing geopolitics, combined with Federal Reserve’s potential policy changes, might lead to further asset reallocation and volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/tariffs-fed-rate-cut-crypto-impact/