- Coinbase’s stock dropped significantly by 12% on August 2, 2025.

- The market volatility is linked to the U.S. Federal Reserve’s shifting monetary policies.

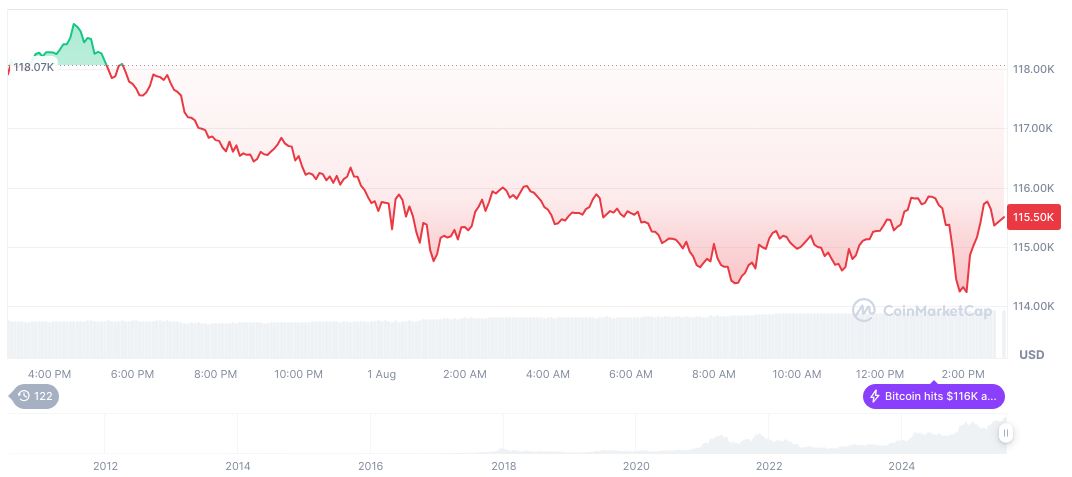

- Major cryptocurrencies like Bitcoin and Ethereum also experienced high liquidations.

Coinbase’s stock plummeted 12% during U.S. trading hours, its steepest dip since April, amidst heightened market volatility tied to Federal Reserve policy expectations.

This event signals broader market uncertainty, driven by investor reactions to the Fed’s economic outlook, impacting major cryptocurrencies like Bitcoin and Ethereum.

Federal Reserve’s Policies Influence Investor Sentiment

Coinbase’s stock decline corresponds with a broad risk-off trend amid changing expectations around the U.S. Federal Reserve’s monetary policy. Jerome Powell, the Federal Reserve Chairman, emphasized that “the economy is in a solid position, with inflation slightly above the target. The current policy stance puts us in a favorable position to respond in a timely manner.” This broader market apprehension influenced not only Coinbase but also key cryptocurrencies, sparking a notable shift in investor sentiment and contributing to high volatility. Liquidations were substantial, with $438 million affected in the past 24 hours, notably impacting Bitcoin and Ethereum.

Changes in monetary policy are sparking apprehension across the market, affecting prominent assets like Bitcoin and Ethereum. On-chain data signifies a risk-averse sentiment, highlighted by forced liquidations on major derivatives platforms such as Binance. As caution continues to influence investment decisions, leaders from the cryptocurrency space remain reticent, refraining from public commentary on this issue.

Insights from Coincu’s research highlight the potential influence of Federal Reserve policies on financial markets. With anticipated changes thwarting near-term market expectations, volatility may continue to impact crypto assets. The crypto sector must adjust to evolving economic indicators, with market participants advised to track policy developments closely for informed decision-making.

Historical Context, Price Data, and Expert Insights

Did you know? While Coinbase’s current stock dip is notable, similar sell-offs were seen during regulatory shocks in March 2023 and April 2025, highlighting a recurring pattern in market reactions to macroeconomic developments.

Bitcoin (BTC) currently stands at $113,857.07 as of the last update from CoinMarketCap, with a market capitalization of 2.26 trillion dollars. Its price has seen a 0.46% decline over the past 24 hours. Longer-term, Bitcoin appreciated by 8.48% over 60 days and 19.02% over 90 days. Recent volatility is attributed to uncertain macroeconomic policies, impacting on-chain activities and investor strategies.

Insights from Coincu’s research highlight the potential influence of Federal Reserve policies on financial markets. With anticipated changes thwarting near-term market expectations, volatility may continue to impact crypto assets. The crypto sector must adjust to evolving economic indicators, with market participants advised to track policy developments closely for informed decision-making.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/coinbase-stock-drops-12-percent/