- U.S. stock indices saw declines. Crypto sector had sharp losses, notably Coinbase.

- Over 16% drop for Coinbase shares.

- Reflects broader market pessimism and volatility.

On August 1, 2025, U.S. stock markets experienced sharp declines, with crypto-related stocks like Coinbase and Circle leading losses, attributed to underwhelming financials and negative sentiment.

These significant drops highlight investor concerns over volatility in both equities and crypto markets, impacting sentiment and investment strategies across the financial sector.

Crypto Stocks Suffer Sharp Declines as Coinbase Drops 16%

The U.S. saw a marked downturn in its stock market on August 1, 2025, with a particular focus on the crypto-related sector’s steep losses. Coinbase led the declines, falling over 16%, while Strategy and Circle shares each plummeted over 8%. This followed underwhelming financial disclosures and contributed to the broad market downdraft.

Immediate market implications indicate a cautious approach among investors, influenced by Coinbase’s reported Q2 revenue missing expectations. The announcement of reduced market volatility was flagged as a challenge for transaction-based income, contributing to further share price erosion.

As of now, there are no recorded quotes from key players or leadership in the crypto sector regarding the sharp market decline on August 1, 2025.

Historical Context, Price Data, and Expert Analysis

Did you know? Similar past selloffs, like those in mid-2024, saw crypto equities and tokens decline by 10-30% during macroeconomic uncertainties, highlighting the market’s responsive volatility.

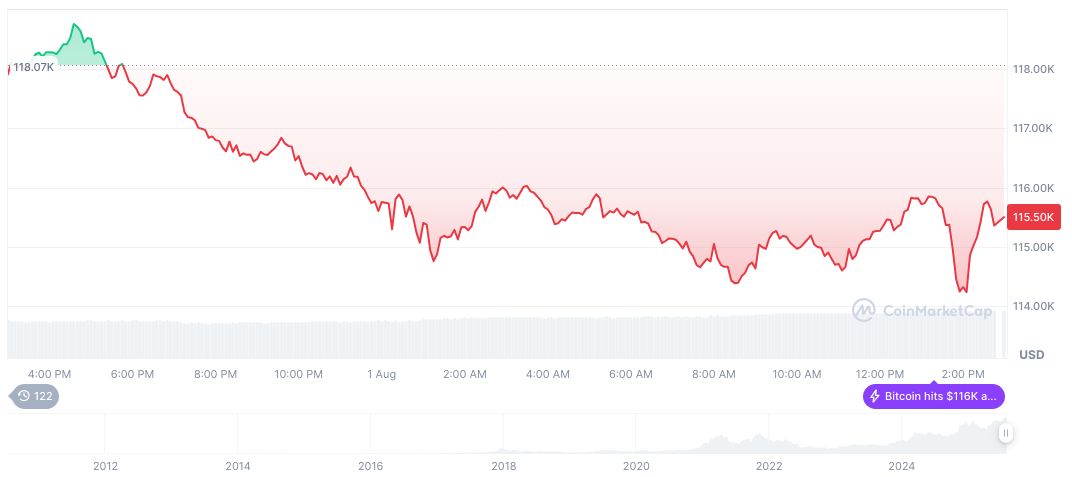

Bitcoin (BTC) currently trades at $113,942.48, with a market cap of $2.27 trillion as per the latest CoinMarketCap data. BTC observed a 1.38% drop in the last 24 hours and a 3.06% weekly decline. Despite recent challenges, BTC has shown resilience over the past 90 days with a gain of 18.76%.

Coincu’s research indicates ongoing financial uncertainties may pressure crypto valuations into Q3 2025. Analysts point to potential regulatory developments influencing market directions, given historical patterns of market reactions to policy shifts. These elements could act as crucial determinants in the market’s path moving forward.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-stocks-crypto-decline/