- Markets anticipate two Fed rate cuts, influencing Bitcoin prices.

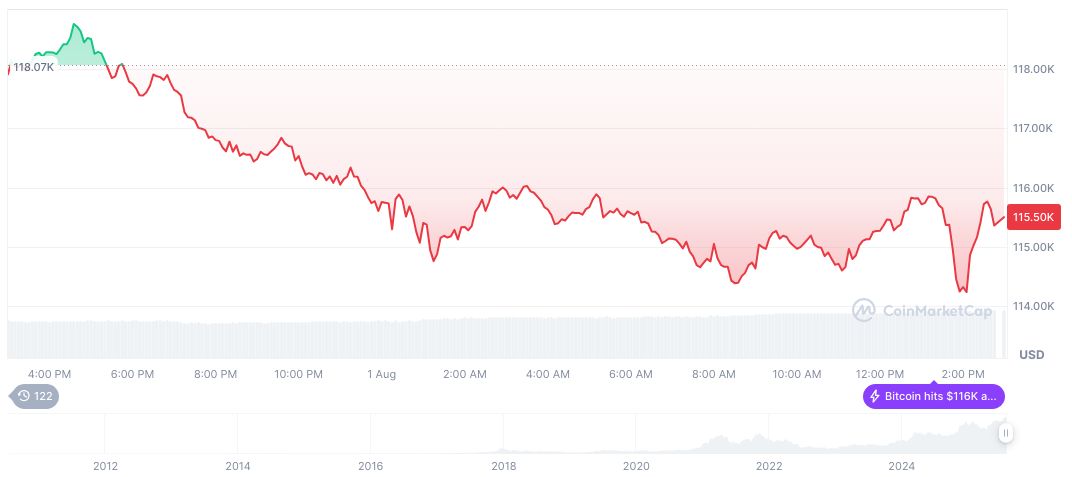

- Bitcoin price drops 3.22% in 24 hours.

- Strong signals urge traders to reposition portfolios.

Traders anticipate two Federal Reserve rate cuts by December 2025, influenced by macroeconomic indicators such as inflation and new tariffs set by President Trump.

Expectations for dovish monetary policy bolster risk appetite in cryptocurrency markets, potentially leading to significant price movements in major assets and DeFi protocols.

Bitcoin Prices React to Anticipated Fed Rate Cuts

Market analysts report heightened trader activity as they incorporate expectations of two rate cuts. This adjustment coincides with U.S. economic data influencing financial predictions. August 1 saw market tools predict a high possibility of cuts before year’s end. The Federal Reserve Board, led by Jerome Powell, has not provided direct statements confirming a scheduled rate reduction plan. CME Group’s FedWatch tool indicates a 62.6% probability for a 25 basis point decrease by September.

Expectations of rate reductions this year have initiated shifts in asset positions. Anticipation of monetary easing could enhance liquidity, fostering a favorable environment for risk assets. Financial analysts foresee the cryptocurrency market reacting positively if the Federal Reserve signals a dovish stance. Historically, volatile August extends caution. Despite the lack of explicit remarks from Federal Reserve Chair Powell, markets position for rate policy shifts.

“The probability of the Fed keeping interest rates unchanged in September is 35.4%, the cumulative probability of a 25 basis point rate cut is 62.6%, and the cumulative probability of a 50 basis point rate cut is 2.0%,” said Jerome Powell, Chair, Federal Reserve.

Historical Rate Cuts and Their Influence on Crypto Markets

Did you know? Rate cuts can bolster cryptocurrency markets, as seen in 2019-2020, prompting significant Bitcoin and Ethereum rallies. Such historical precedents illustrate the dual nature of market volatility in anticipation or disappointment.

Bitcoin (BTC) maintains a price of $113,371.74 with a market cap of 2,256,145,293,314.00 and a dominance of 61.03%. Over the last 24 hours, trading volume reached $89,152,821,502, despite a 3.22% decrease in price according to CoinMarketCap. The circulating supply now totals 19,900,421 out of a 21,000,000 maximum. Historical data shows BTC prices increased 17.75% over 90 days.

The Coincu research team suggests strong correlations exist between rate cut expectations and risk asset valuations. Such financial influences are historically significant, encouraging liquidity infusion into markets. Current positioning indicates anticipation but remains subject to potential policy deviations. Regulatory aspects surrounding these movements highlight complex interactions between governmental fiscal strategies and market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cuts-end-2025/