- Federal Reserve maintains rates, hinting at possible year-end cuts.

- Rate cut probability drops to 39% after July meeting.

- Market reaction subdued, impacting crypto trends historically tied to rate changes.

On July 31, 2025, the Federal Reserve held interest rates steady, hinting at a potential cut later this year, impacting crypto assets like Bitcoin and Ethereum.

Traders see falling chances for a September rate cut, affecting Treasury yields and historically driving crypto markets, but primary sentiments remain mixed amid Fed indecision.

Market Rate Cut Expectations Fall to 39% from 75%

Market expectations for a future rate cut have notably changed, now standing at a 39% probability for September, according to the CME FedWatch tool. This shift resulted from new economic indications and leadership’s cautious stance. Such anticipation influences various markets, including U.S. GDP Advance Estimate for Q2 2025 and U.S. Treasuries, which showed marginal movement.

Chair Jerome Powell stated that the committee’s policies remain adaptable and reliant on economic data. In the crypto sphere, impacts have traditionally been observed during rate cut expectations, often resulting in increased liquidity. However, current sentiment seems mixed, awaiting further confirmations.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 4.25 to 4.50 percent.” — Jerome Powell, Chair, Federal Reserve

Historical Context, Price Data, and Expert Insights

Did you know? The Federal Reserve’s rate decisions have previously led to significant Bitcoin price movements; easing cycles can lead to crypto price increases as seen in 2020 and 2023.

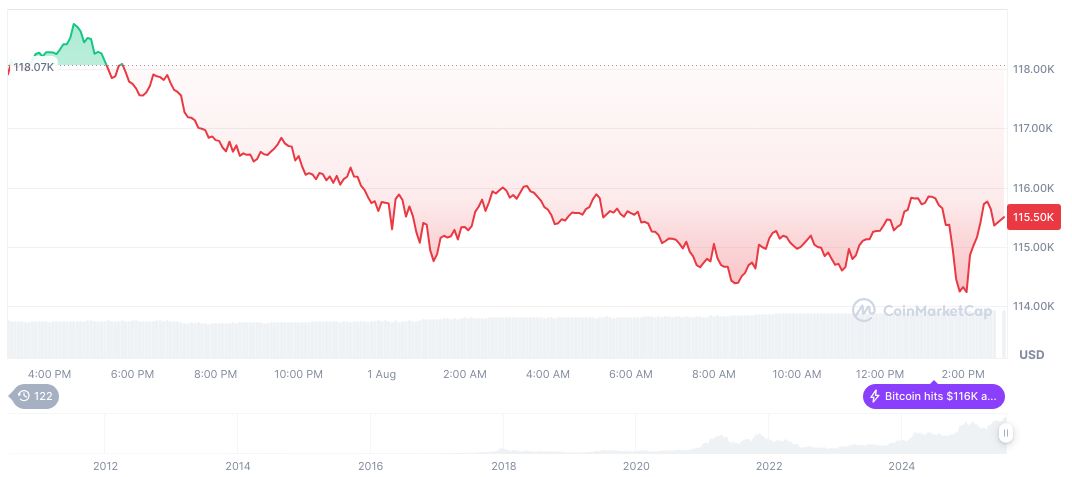

Bitcoin (BTC) is currently priced at $113,764.37, reflecting a market cap surpassing $2.26 trillion. Holding a 61% market dominance, its 24-hour trading volume reached $90.40 billion, a 31.66% increase. BTC’s recent performance shows a 3.25% drop over 24 hours, juxtaposed with positive shifts over 30, 60, and 90 days, CoinMarketCap reports.

Coincu analysts note fluctuating rate expectations could hold substantial implications for crypto investments as reduced borrowing costs may bolster liquidity and investor appetite. Historical contexts suggest potential for price surges in blockchain assets, inviting strategic watch over Federal Reserve decisions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-expectations-fall/