BNB has achieved a historic milestone, surpassing the threshold of 119 billion dollars in market capitalization and ranking 185th among the most important assets in the world, according to data provided by 8marketcap. This achievement allows BNB to overtake giants like SoftBank Group and Nike in terms of market value, consolidating its reputation as one of the leading digital assets globally.

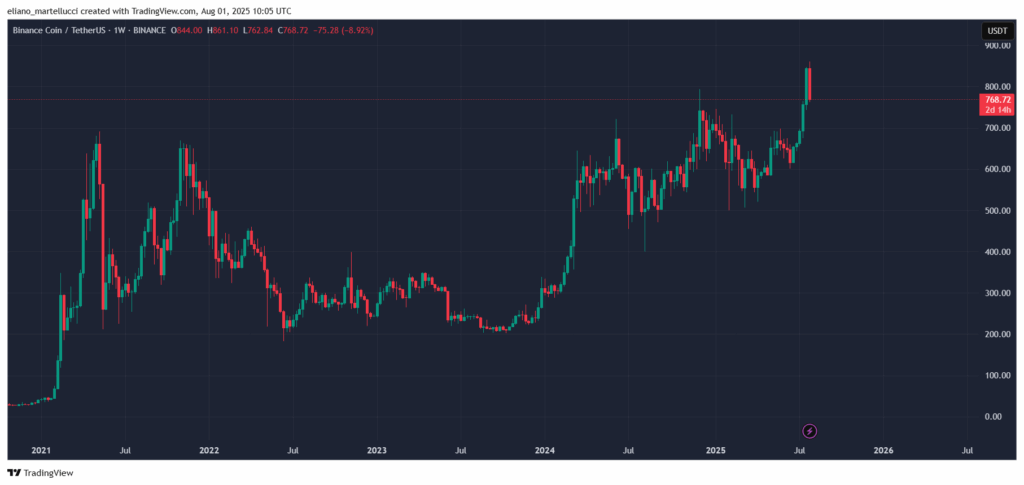

On July 28, BNB reached a new all-time high of 861 dollars, marking an increase of 7.27% in the last 24 hours and a growth of 12.44% over the course of a week. This leap allowed the token to climb 12 positions in the global ranking of assets, which includes listed companies, funds, and other internationally significant financial instruments.

A spokesperson for Binance emphasized how:

“the continuous rise of BNB among the main global assets demonstrates the growing legitimacy of digital assets as leading players in the world capital markets”.

The spokesperson also highlighted that the growth of BNB not only strengthens its role in the crypto finance sector but also consolidates its emerging status as a bridge between traditional financial markets and the decentralized future of Web3.

The Entry of BNB into Global Portfolios

The market performance of BNB is accompanied by a growing adoption by public and sovereign institutions. Several publicly traded companies, including Nano Labs, Windtree Therapeutics and Liminatus, have started to include BNB in their treasury portfolios. This choice represents a strategic shift that goes beyond the traditional Bitcoin and Ethereum, marking a new phase in companies’ approach to digital assets.

To further strengthen this trend, the Kingdom of Bhutan recently announced the inclusion of BTC, ETH, and BNB in its sovereign strategic reserves. The selection of BNB was motivated by its solid market capitalization, high liquidity, and high-performance blockchain infrastructure, elements that make it particularly attractive for institutional investors and asset allocators at the national level.

The factors behind the success of BNB

According to Binance Research, the growth of BNB is the result of a combination of key factors that drive its demand and trust:

- Strong user confidence in the Binance ecosystem, which continues to expand and offer new opportunities for both retail and institutional users.

- Versatility of use: BNB is used as collateral in DeFi protocols, to obtain discounts on trading fees, for the payment of gas fees, for transactions, and for governance within the blockchain.

- Deep liquidity: the presence of a liquid market allows for rapid transactions and high volumes, a fundamental element to attract large investors.

- High-performance blockchain infrastructure: the technology on which BNB is based ensures speed, security, and scalability, essential characteristics to support large-scale adoption.

These elements have helped to strengthen the position of BNB as a benchmark asset not only for the crypto world, but also for the traditional financial landscape in search of innovation and diversification.

BNB: a digital “Blue-Chip” for the future of finance

The rise of BNB in the global asset ranking testifies to the maturation of the digital asset sector. The token is establishing itself as a true digital “blue-chip,” attracting the growing interest of financial institutions, listed companies, and even sovereign governments.

The ability of BNB to act as a bridge between traditional finance and the decentralized world of Web3 represents a clear signal: digital assets are becoming an increasingly central component in investment portfolios globally.

The inclusion of BNB in the strategic reserves of countries like Bhutan and in the treasuries of public companies indicates a paradigm shift, where diversification and technological innovation are seen as fundamental levers for growth and financial resilience.

Conclusions: BNB and the new era of global assets

The surpassing of 119 billion dollars in market capitalization and the overtaking of giants like SoftBank and Nike mark a turning point for BNB and the entire digital asset sector. The growing adoption by institutions and governments, combined with a solid technological infrastructure and increasing trust from users, positions BNB as one of the most promising and influential assets in the contemporary financial landscape.

The trajectory of BNB suggests that the future of finance will be increasingly characterized by the integration between traditional instruments and digital innovations, with assets like BNB ready to play a leading role in the construction of a new global economic order.

Source: https://en.cryptonomist.ch/2025/08/01/bnb-over-119-billion-in-capitalization-surpasses-softbank-and-nike-and-ranks-among-the-top-global-assets/