- Fed Governors call for rate cuts, citing economic growth concerns.

- Interest rate changes affect global liquidity and crypto markets.

- Potential short-term crypto market rally due to Fed’s stance.

Federal Reserve Governors Christopher Waller and Michelle Bowman expressed differing views on interest rates on August 1, reflecting divergent economic outlooks amid slowing growth.

Their statements could impact the crypto market, affecting the U.S. dollar and digital assets like BTC and ETH, as traders anticipate changes in monetary policy.

Fed Governors’ Stance Signals Policy Shift Favoring Rate Cuts

Federal Reserve Board Governors Waller and Bowman issued statements advocating for different interest rate strategies. Waller emphasized the need for policies closer to a neutral stance, noting “Policymakers’ hesitance to lower interest rates could risk unnecessary damage to the labor market.” Bowman suggested gradual cuts were suitable given growth slowdowns. Both cited diminished upside risks to price stability in recent assessments.

A shift towards rate cuts could intensify market expectations for increased liquidity. This action may reduce borrowing costs, potentially accelerating economic activity. The immediate effect on crypto markets could lead to a rally, as such adjustments often bolster risk asset appetites.

Waller and Bowman’s insights highlighted concerns over labor market weaknesses. Financial markets have responded with varied reactions, showing optimism towards an impending dovish policy shift. The stance taken by these governors underscores a delicate balance in monetary policy decisions, reflecting broader economic challenges.

Crypto Markets React to Federal Reserve’s Dovish Signals

Did you know? In 2019 and March 2020, similar Fed signals led to substantial inflows in crypto markets, highlighting pattern recognition as an essential strategy for trading decisions amid economic shifts.

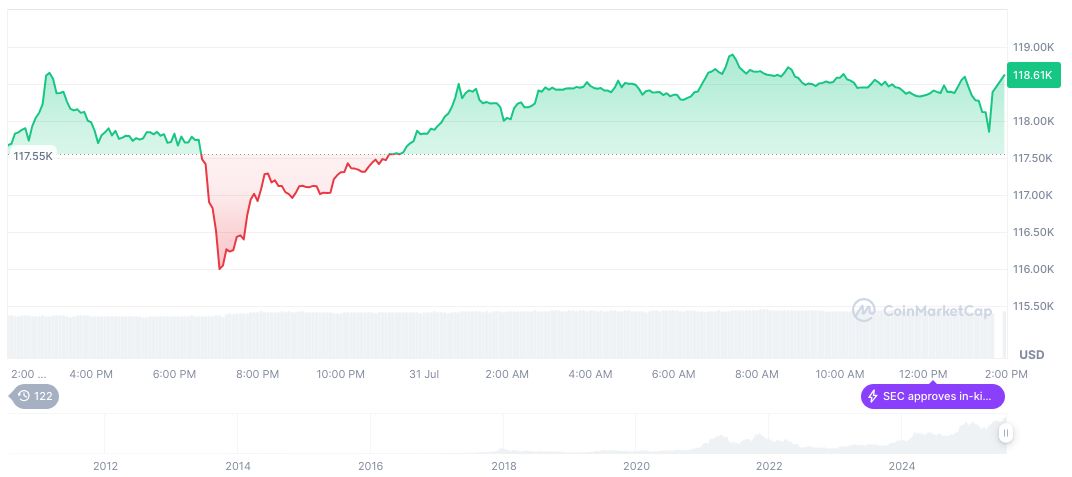

Bitcoin was priced at $115,275.17 with a market cap totaling approximately $2.29 trillion as of August 1, 2025. Over the past 90 days, BTC appreciated by 20%, though it recently saw a 2.71% decline in one day. Trading volumes hit $83.65 billion, reflecting a 19.28% decrease, as reported by CoinMarketCap.

The Coincu research team suggests that adjustments in Federal Reserve policy can prompt shifts in both traditional and crypto financial markets. Previous similar policy shifts resulted in significant market liquidity and visible investor interest boosts, attributed to lowered borrowing costs and heightened risk tolerance in capital markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-governors-rate-cut-decision/