- Introduction of licensing for stablecoin issuers; no licenses yet issued.

- This aims to enhance the stability of digital assets in Hong Kong.

- Initial market reactions are muted; significant shifts are anticipated.

The Hong Kong Stablecoin Bill took effect on August 1, 2025, establishing a licensing system for fiat stablecoin issuers to enhance regulatory oversight in the region.

This development is expected to impact fiat-referenced stablecoins, shaping Hong Kong’s digital asset market and driving regulatory clarity for stablecoin issuance.

Regulatory Developments and Market Implications

The Hong Kong Stablecoin Bill implements a formal licensing regime for stablecoin issuers. Effective August 1, 2025, it seeks to regulate fiat stablecoins, enhance financial stability, and promote innovation. HKMA is at the center of this regulatory change. As the new regulatory framework takes hold, immediate implications include a waiting period for license issuers and careful assessment by existing stablecoins operating in Hong Kong. This situation might affect liquidity pools, including prominent stablecoins like USDT and USDC. Market reactions appear cautious, with the HKMA urging market participants to communicate responsibly.

Market participants are advised to exercise due caution in their public communications, as well as refrain from making statements that could be misinterpreted or create unrealistic expectations. [HKMA Licensing Guidance](https://www.hkma.gov.hk/eng/news-and-media/press-releases/2025/07/20250729-4/)

Market participants are advised to exercise due caution in their public communications, as well as refrain from making statements that could be misinterpreted or create unrealistic expectations. [HKMA Licensing Guidance](https://www.hkma.gov.hk/eng/news-and-media/press-releases/2025/07/20250729-4/)

Global Trends and Expert Insights

Did you know? The enactment of Hong Kong’s Stablecoin Bill on August 1 parallels regulatory shifts in the EU’s MiCA, illustrating a broader global trend towards structured cryptocurrency regulation.

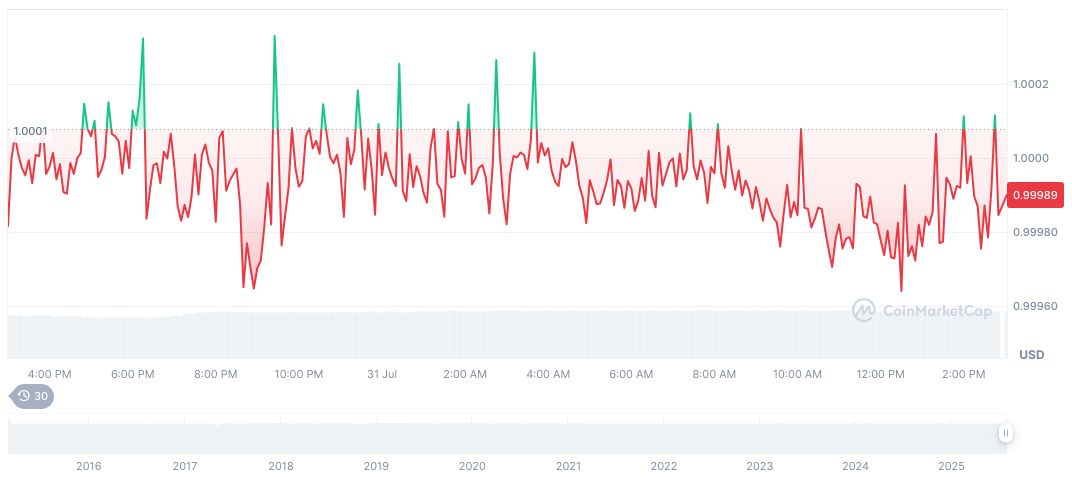

According to CoinMarketCap, Tether USDt (USDT) holds a steady price at $1.00 with a market cap of $163.75 billion, indicative of its significant role in global markets. Despite minor fluctuations over recent months, USDT’s dominance stands at 4.35%, reflecting stable investor sentiment and usage. Coincu’s research team highlights that Hong Kong’s new regulations may bolster institutional trust in digital assets. Regulatory clarity is expected to attract investment in technological infrastructure and financial innovation, ultimately benefiting both local and global markets.

According to CoinMarketCap, Tether USDt (USDT) holds a steady price at $1.00 with a market cap of $163.75 billion, indicative of its significant role in global markets. Despite minor fluctuations over recent months, USDT’s dominance stands at 4.35%, reflecting stable investor sentiment and usage. Coincu’s research team highlights that Hong Kong’s new regulations may bolster institutional trust in digital assets. Regulatory clarity is expected to attract investment in technological infrastructure and financial innovation, ultimately benefiting both local and global markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-bill-licensing/