- SEC suggests changes to crypto custody and trading to promote integration.

- Chairman Atkins emphasizes regulatory adaptation.

- This may boost institutional participation in the crypto market.

U.S. SEC Chairman Paul S. Atkins announced plans to revamp crypto asset custody systems and enable parallel trading of crypto and non-crypto securities, signaling potential regulatory changes.

This initiative aims to modernize market structures, boost crypto integration, and potentially enhance institutional participation, reflecting a notable shift in U.S. regulatory strategy toward digital assets.

SEC Overhauls Crypto Regulations Targeting Tokenized Securities

The U.S. SEC is exploring important changes to its regulatory framework. Under the guidance of Chairman Paul S. Atkins, the SEC intends to revise the crypto custody system to foster the development of crypto asset custody businesses. Simultaneously, Atkins has instructed the development of a framework for parallel trading of crypto and non-crypto securities.

These changes are expected to have far-reaching implications for the crypto market. By considering amendments to the National Market System Rules, the SEC is positioning itself to accommodate tokenized securities trading alongside traditional equities, enhancing market efficiency and potentially lowering costs. As Paul S. Atkins stated, “The SEC must not allow legacy rules and regulations that did not contemplate on-chain securities to act as roadblocks to the growth of blockchain technology.”

Market and community reactions have been largely positive, with industry experts noting the potential positive impact on institutional engagement with digital assets. SEC Commissioner Hester Peirce has been a vocal advocate of such regulatory innovations, emphasizing the importance of transparency and efficient market structures.

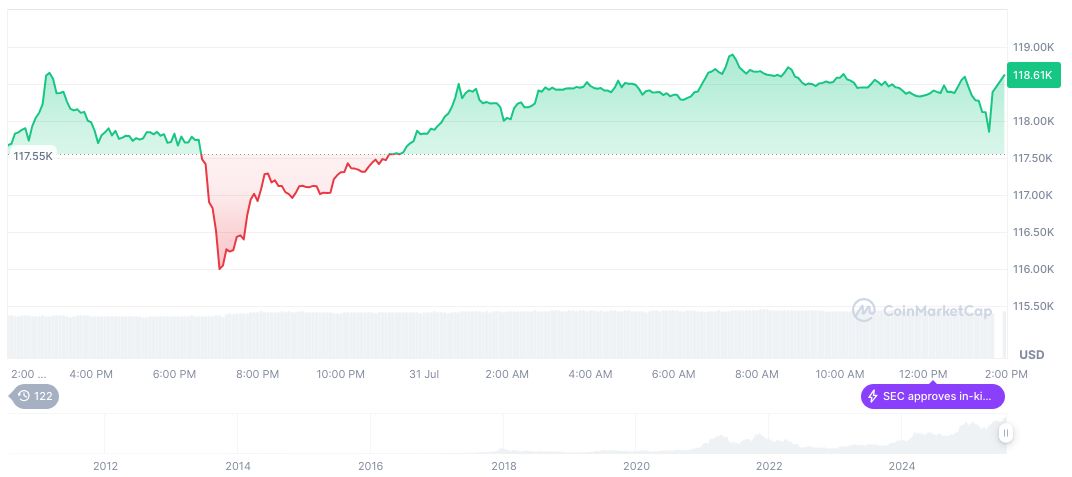

Bitcoin Price Holds Above $118k Amid Regulatory Changes

Did you know? The SEC’s recent efforts to integrate crypto with traditional markets echo initiatives from a decade ago when regulatory frameworks for exchange-traded products were first proposed.

As of July 31, 2025, Bitcoin (BTC) holds a market price of $118,526.28, with a market cap of $2.36 trillion, according to CoinMarketCap. Over the past 24 hours, trading volume reached $69.32 billion, reflecting a 0.65% price increase. The circulating supply stands at 19,899,915 BTC out of a 21 million max supply.

Expert analysis from Coincu suggests that these regulatory changes are likely to lead to significant capital inflows into crypto markets. They may also improve trading efficiency and liquidity, driving further growth in decentralized finance and tokenization sectors while ensuring investor protection. Atkins’ Remarks at Crypto Roundtable on Tokenization highlight the alignment of these efforts with long-term market goals.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-crypto-custody-trading-changes/