Purchased 14,939.58 ETH at $3,809.97 each for a total of approximately 56 million dollars: this is how The Ether Machine inaugurates its accumulation strategy, coinciding with the tenth anniversary of Ethereum on July 30, 2025.

La Ether Reserve ha acquistato quasi 15.000 ETH oggi come parte della nostra strategia di accumulo a lungo termine. Questo porta il totale di ETH acquistati e impegnati a 334.757 con fino a $407.000.000 USD rimanenti per ulteriori acquisti di ETH.

“Non potevamo immaginare un modo migliore per commemorare…

— The Ether Machine (@TheEtherMachine) 30 luglio 2025

How is the Ether Machine strategy on Ethereum (ETH) born?

The decision, led by Andrew Keys, Co-Founder and Chairman, represents one of the most determined moves ever seen in the sector: the company indeed aims to build “the largest and most sophisticated institutional ETH treasury,” suitable for managing and supporting the role of ETH as a pillar of the future decentralized economy.

The Ether Machine was born from the merger between The Ether Reserve LLC and Dynamix Corporation, a SPAC listed on NASDAQ under the ticker DYNX. This ambitious consortium aims to establish itself as a leader in yield services (staking and DeFi) and infrastructure on Ethereum, explicitly targeting enterprises, DAOs, and native blockchain builders.

What does the purchase mean for the Ethereum market?

The news, communicated precisely on July 30, 2025, represents a very strong signal of confidence in the future of Ethereum and ETH as an asset, especially in the eyes of institutional investors. So far, 334,757 ETH have been purchased or already allocated for purchase by The Ether Reserve, with a remaining availability of 407 million dollars allocated for further accumulations in the coming days.

The transparency highlighted in the structure of the operation — each purchase is the result of the 97 million dollars raised with a private placement — also represents a reference model for on-chain public treasury practices. It should be emphasized: this maneuver positions The Ether Machine as one of the entities with the largest ETH exposure in the entire regulated market.

What is the symbolic value of the operation on the tenth anniversary of Ethereum?

According to Keys’ words, “we couldn’t have imagined a better way to celebrate Ethereum’s 10th anniversary”: the choice to link the start of the treasury to this occasion is highly strategic. The symbolic influence is very strong for the community: it demonstrates maturity, long-term vision, and a commitment that goes beyond mere speculation.

But the concreteness does not end here. In parallel with the announcement, Keys also donated 100,000 dollars of his own to the Protocol Guild, the community initiative that funds and protects core developers — those contributors who, often in the shadows, support the security and evolution of the Ethereum blockchain.

Il presidente di Ether Machine @AK_EtherMachine ha donato $100,000 al Protocol Guild per supportare i ricercatori e sviluppatori open-source a lungo termine responsabili del livello base di Ethereum 🎁

“Ethereum non esisterebbe senza il lavoro instancabile dei suoi sviluppatori principali. Questa donazione è un simbolo…

— The Ether Machine (@TheEtherMachine) 30 luglio 2025

What is the Protocol Guild and what role does it play for Ethereum?

The Protocol Guild has contributed over millions of dollars to more than 150 developers, researchers, and maintainers of the Ethereum network. Thanks to innovative funding models (direct support provided in crypto), it is now among the reference points in the “sustainable open-source” paradigm in Web3.

The contribution of Keys represents not only a symbolic reward, but also an incentive to maintain high standards and the independence of developers, often subject to burn-out and financial instability despite their crucial role in decentralization.

Who is The Ether Machine and why can it influence the future of ETH?

The stated mission is to build an institutional position in ETH that can generate, optimize, and return value in the ecosystem through staking, restaking, and professionally managed DeFi. Not only that: Ether Machine promises to offer “turnkey” solutions for businesses and DAOs that require secure, scalable infrastructure compliant with Ethereum consensus logic.

The medium to long-term goal is clear: to maintain, grow, and strategically use the ETH treasury, also thanks to yield tools (staking), to promote financial resilience and the involvement of the new Internet economy.

What is restaking and why does it matter?

Restaking involves using the same deposited ETH to participate in various security and yield protocols, thereby increasing efficiency and earning potential, but with specific management and security risks.

What to expect now from Ether Machine and the ETH price?

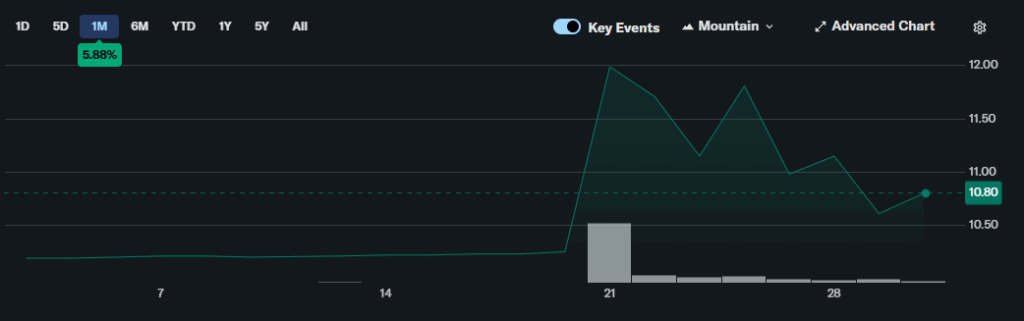

The company announced that new purchases will be communicated in the coming weeks, leveraging the funds still “in cash” after the private placement. If this pace is maintained, Ether Machine could consolidate one of the largest on-chain ETH positions held by regulated actors, influencing market psychology and liquidity dynamics.

The operation of Ether Machine fits into a scenario where Ethereum celebrates a decade of continuous evolutions: from the ICO to the DeFi boom, up to establishing itself as the leading platform for innovation, security, and scaling on public blockchain.

Prospects and impact: what can change for Ethereum?

The commitment of Ether Machine in consolidating a significant ETH treasury marks a maturation of the institutional role in the crypto sector. On one hand, it stabilizes trust in the token, on the other, it launches a transparent model of financing, management, and public governance of digital resources.

The future of Ethereum — and all related assets — will depend on how these initiatives manage to enhance both the resilience of the blockchain and the opportunities for investors and developers. Everything can change in the coming weeks: new announcements are expected, the institutional “treasury war” is just beginning. Follow the community to discover how the Ethereum landscape evolves.

Source: https://en.cryptonomist.ch/2025/07/31/ether-machine-record-purchase-of-15000-eth-for-the-10th-anniversary-of-ethereum/