- JPMorgan highlights the undervaluation of Coinbase’s Circle-related business impacting its stock strategy.

- Coinbase expects robust revenue from its USDC investments.

- USDC ecosystem benefits align with institutional adoption strategies.

On July 29, 2025, a JPMorgan Chase report highlighted Coinbase’s profitable partnership with Circle, significantly valuing Circle-related businesses at up to $60 billion for Coinbase shareholders.

The market may undervalue Coinbase’s USDC ecosystem role, despite significant high-margin revenue contributions in the first quarter of 2025, impacting Coinbase’s stock valuation positively.

Coinbase’s USDC Involvement: Financial Advantages and Market Impact

JPMorgan’s latest analysis suggests Coinbase’s investment in Circle and its robust involvement with USDC stablecoin could lead to substantial financial returns. JPMorgan reported that this business aspect may be undervalued by the market, thus impacting shareholder forecasts. Coinbase’s collaboration with Circle brings $300 million in Q1 revenue from issuance payments, hinting at potential gains.

The partnership reflects substantial value through shared revenue streams like the Circle Reserve Fund. By holding $13 billion in USDC balances, Coinbase generated $125 million, supported by a 20-25% profit margin. This indicates the ecosystem’s essential role in institutional finance mobilization.

“We have always believed in having a token-based solution on public blockchains.” — Naveen Mallela, Global Co-Head Blockchain, JPMorgan

No major reactions from regulatory or industry bodies were recorded at the time.

USDC’s Institutional Role and Regulatory Prospects

Did you know? The migration of stablecoins like USDC to public Layer 2 networks marks a significant shift in institutional blockchain engagement, presenting competitive challenges to private digital asset initiatives.

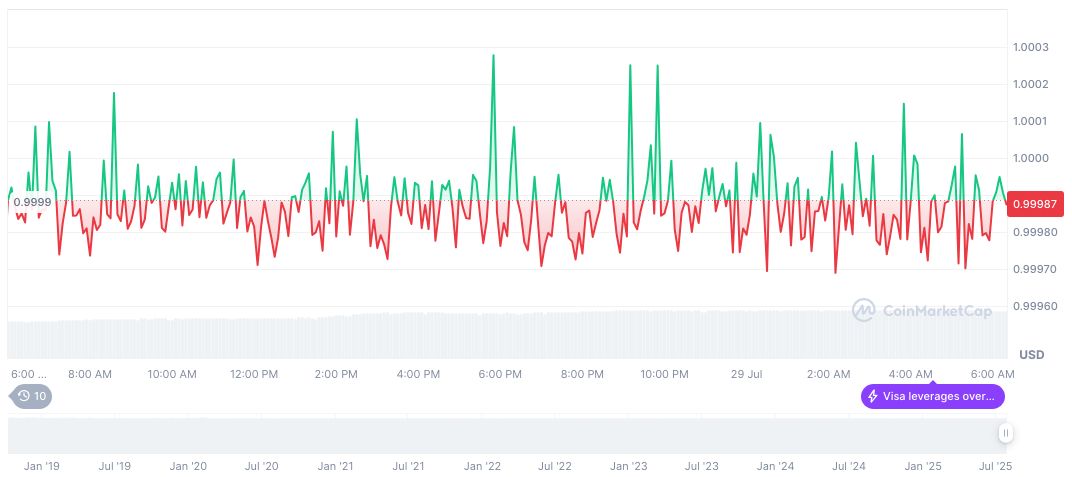

USDC (USDC) holds steady at $1.00 with a market cap of $63.78 billion, as reported by CoinMarketCap. Circulating supply stands at approximately 63.79 billion tokens, while 24-hour trading volume reached $14.21 billion, down by 13.67%. Minimal fluctuation is observed over recent months.

Coincu research team proposes that the expansion of USDC participation in institutional DeFi could yield favorable regulatory outcomes. Leveraging USDC’s established network and functionality could motivate further collaboration across financial sectors, enhancing its future prospects.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/coinbase-usdc-partnership-potential/