- Feng and group launder 140 million yuan via Bitcoin.

- 90 Bitcoins recovered, aiding loss recovery.

- Court imposes prison terms and fines for eight involved.

In Beijing’s Haidian District, former employee Feng exploited a short video company’s reward policy, illegally embezzling 140 million yuan using cryptocurrency laundering techniques, leading to a court sentence.

The case highlights vulnerabilities in corporate reward systems and the sophisticated methods employed in cryptocurrency laundering, emphasizing the need for tighter oversight and compliance in digital asset transactions.

Sentencing in Beijing for $19M Crypto Crime

A former employee of a Beijing video platform, named Feng, was involved in embezzling 140 million yuan by exploiting company reward policies. Feng, along with Tang and Yang, converted the stolen funds into Bitcoin using eight overseas exchanges, employing a “coin-mixing” method.

This event resulted in significant legal action with the Haidian District People’s Court sentencing Feng and six others. The sentencing includes prison terms from three to fourteen years, in addition to fines. Over 90 Bitcoins were surrendered, partially aiding in loss recovery.

Market reactions have been mixed with no significant reports on market disruptions or asset impacts. No official statements from affected company officials or major industry players have been recorded on this incident.

Insights into Crypto Laundering Tactics and Regulatory Concerns

Did you know? The use of a “coin-mixing” method in this case mirrors tactics seen in high-profile privacy laundering incidents before, highlighting ongoing challenges in tracing cryptocurrency amidst regulatory scrutiny globally.

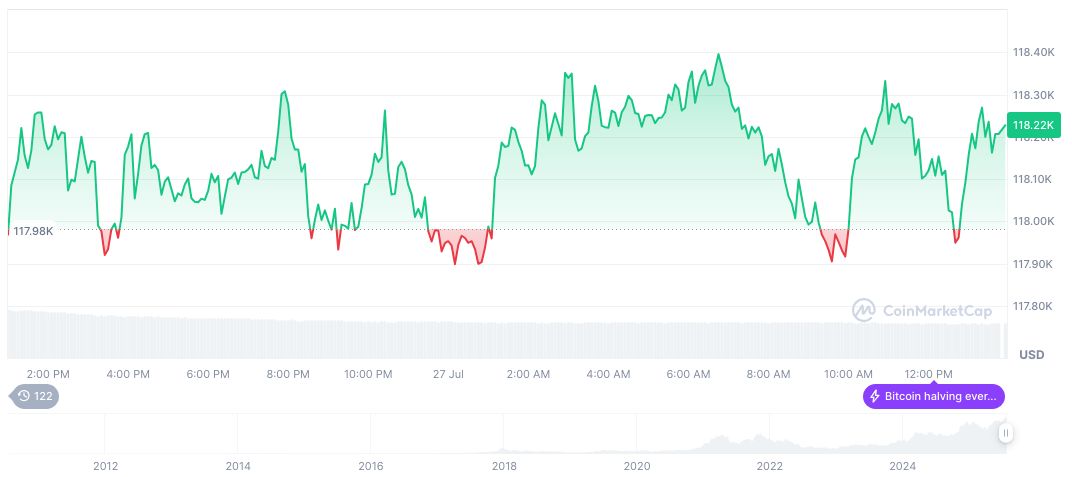

As per CoinMarketCap, Bitcoin (BTC) is trading at $119,356.54 with a market cap of 2.38 trillion and a dominance of 60.21%. Significant changes include a 24-hour volume rise of 17.85% and a 90-day price increase of 25.59%, reflecting substantial market volatility.

The Coincu research team emphasizes the strong need for regulatory enhancement. Estimating potential outcomes suggests increased scrutiny on privacy-focused technologies and exchanges, impacting future crypto-fund flow regulation and compliance standards. “Cases like these typically result in increased scrutiny across the sector, yet there has been no formal response from regulatory bodies.” – Crypto Compliance Expert, Industry Analysis Firm

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/beijing-crypto-laundering-sentencing/