- Strategy raises $2.474 billion, expanding Bitcoin holdings and diversifying corporate strategy.

- Additional funds allocated to general corporate purposes.

- Strategy’s Bitcoin-centric approach continues under Michael Saylor’s leadership.

MicroStrategy has priced 28,011,111 shares of its Class A perpetual preferred stock at $90 each, potentially raising $2.474 billion, with settlement expected on July 29, 2025.

The funds, primarily intended for Bitcoin acquisition, highlight MicroStrategy’s ongoing commitment to digital assets, potentially influencing market sentiment and underscoring Bitcoin’s role in corporate treasuries.

Strategy Raises $2.474 Billion in Share Offering

Strategy has completed the pricing of 28,011,111 variable rate Class A perpetual preferred shares at $90 per share, raising $2.474 billion. Michael Saylor, Strategy’s CEO, announced the pricing and increased issue size from $500 million to $2.521 billion.

Funds will primarily enhance Bitcoin holdings, continuing Saylor’s aggressive digital asset strategy. Secondary allocations will support other corporate initiatives. Market responses indicate strong institutional demand, further validated by prominent institutional underwriters. Michael Saylor emphasized the resounding success of the issue size expansion.

“The expanded preferred stock offering reflects the strong demand from institutional investors for our innovative capital structure.” – Michael Saylor, Founder & CEO, Strategy

Bitcoin Market Dynamics and Institutional Influence

Did you know? Strategy’s prior Bitcoin acquisitions have historically coincided with increased trading volumes, showcasing the market’s positive sentiment toward large-scale corporate investments in digital assets.

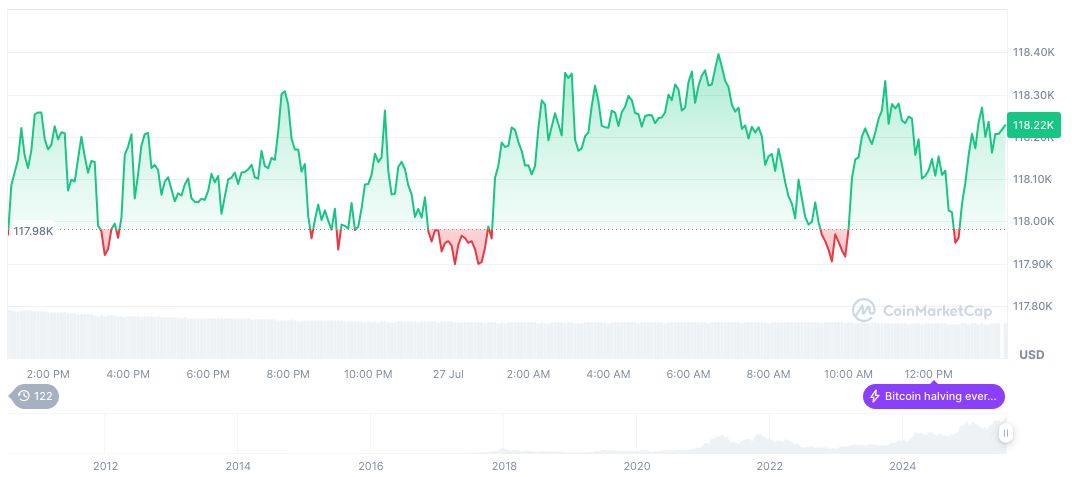

Bitcoin, trading at $119,221.59, shows a market cap of $2.37 trillion and market dominance of 60.25%. Recent fluctuations include a 0.95% increase over 24 hours and a 27.13% rise over 90 days, as reported by CoinMarketCap.

Coincu research indicates the $2.474 billion raise positions Strategy to stabilize its Bitcoin-centered treasury portfolio, potentially influencing market dynamics. Historic trends suggest substantial demand for BTC among institutional investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/strategy-shares-bitcoin-acquisition/