- Federal Reserve rate decision and Hong Kong’s stablecoin regulation.

- Potential for increased crypto market volatility.

- Expert insights on economic and regulatory effects.

Federal Reserve’s interest rate decision and Hong Kong’s impending stablecoin regulation capture global finance attention, impacting cryptocurrency markets extensively in the coming week.

These developments may trigger significant volatility in crypto prices, affect stablecoin issuers, and cause shifts in trading volumes across global markets.

Federal Reserve’s Rate Decision and Its Significance for Crypto

The Federal Reserve will announce its decision on the Federal Funds Rate, an event closely watched by investors and the crypto community alike. Simultaneously, Hong Kong is introducing stablecoin regulation which will affect major stablecoin issuers such as Tether and Circle. These developments represent significant tests for the stability and adaptability of cryptocurrencies. Market attention will also turn to the Fed Chair’s ensuing press conference, where Jerome Powell will provide insights into economic conditions and future monetary policy—important indicators considered critical for crypto volatility. Analyst expectations suggest a potential ripple effect on crypto prices and trading volumes.

The regulatory landscape is also poised to change with Hong Kong’s new stablecoin framework. The announcement is expected to impact centralized stablecoin issuers and could influence DeFi platforms with significant user bases in Hong Kong. Eddie Yue, Chief Executive of HKMA, emphasized the framework’s role in supporting innovation.”

Coincu’s research team indicates that while stablecoin regulations may streamline markets, the combination of macroeconomic signals from the Federal Reserve and global regulatory shifts could enhance crypto market volatility. Financially, sectors caught in regulatory transitions will likely adapt significantly.

Bitcoin Volatility and Historical Effects of Hong Kong Regulations

Did you know? Hong Kong’s past regulatory changes have frequently led to spikes in regional trading volumes, indicating significant local market influence.

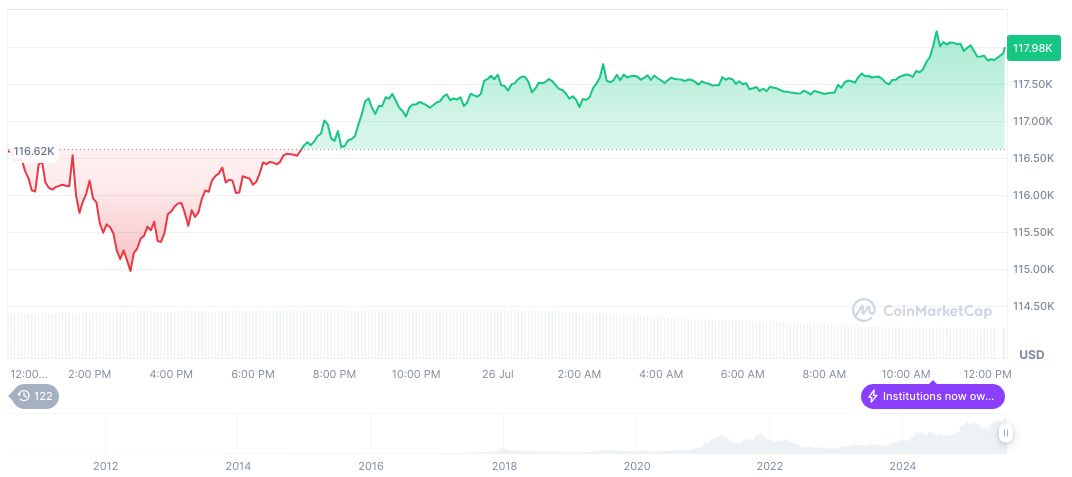

Bitcoin’s market data highlights its ongoing volatility, reflective of macroeconomic impacts. Currently priced at $117,956.46 with a market cap of $2.35 trillion, Bitcoin exhibited recent price changes such as a 1.40% rise in 24 hours but a slight 0.33% decline over the past week. Data via CoinMarketCap illustrates its dominance, holding 60.55% of the market, with trading volume slightly dropping by 32.21% to $65.19 billion in 24 hours.

Coincu’s research team indicates that while stablecoin regulations may streamline markets, the combination of macroeconomic signals from the Federal Reserve and global regulatory shifts could enhance crypto market volatility. Financially, sectors caught in regulatory transitions will likely adapt significantly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-hong-kong-crypto-impact/