- Federal Reserve to hold rates; crypto investors watch for September changes.

- 97.4% odds on unchanged rates for July meeting.

- September’s 25bps cut probability affects BTC, ETH.

According to CME’s “FedWatch” data, there is a 97.4% probability that the Federal Reserve will maintain current rates at the upcoming July 30, 2025, FOMC meeting.

With the anticipated pause in rate changes, cryptocurrency markets, notably BTC and ETH, are experiencing heightened volatility, impacting trader strategies and asset valuations.

Crypto Markets React to Upcoming Federal Decisions

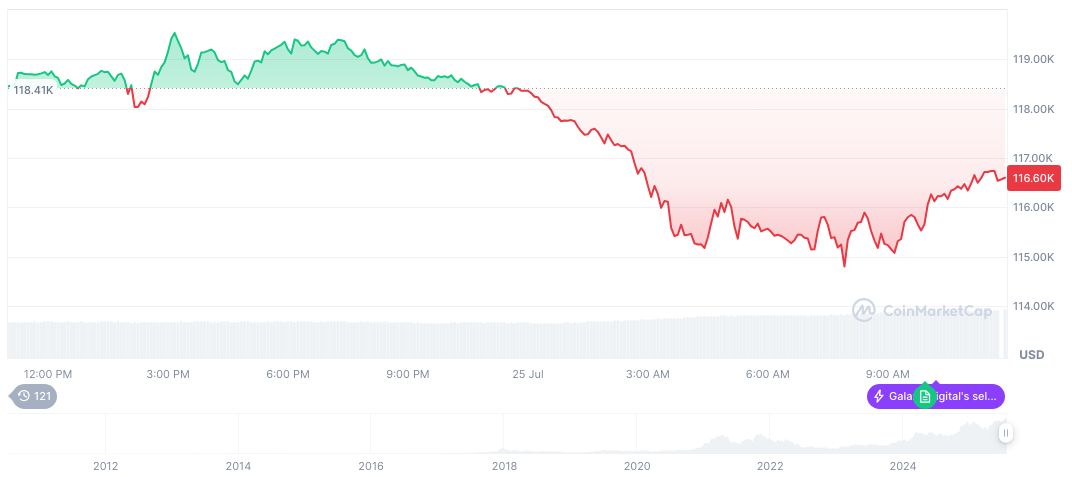

Markets remain poised, given that rate decisions significantly impact the price volatility of crypto assets. For instance, Bitcoin witnessed a temporary decline, touching levels below $116,000 on July 25, spurred by speculation over Federal Reserve policies.

Ethereum’s net supply also saw a rise this past week, resonating with broader market dynamics. These adjustments align with the macroeconomic backdrop set by the Federal Reserve’s possible rate changes. Cryptocurrency exchanges and officials have, so far, refrained from commenting directly on these shifts, possibly due to regulatory quiet periods surrounding such financial announcements.

Historical Context, Price Data, and Expert Insights

Did you know? In previous periods when the Federal Reserve signaled possible rate alterations, such as mid-2023, immediate market reactions included temporary rallies in both Bitcoin and Ethereum, indicating a pattern of short-term volatility.

Bitcoin (BTC) recently fell by 2.34% within 24 hours to $116,474.14, attributing to its current market cap of $2.32 trillion according to CoinMarketCap. BTC maintained 60.85% market dominance with trading volume rising by 36.17% over this last period. These factors correlate with prior Federal monetary announcements, affecting crypto valuations.

The Coincu research team’s analysis highlights a potential financial impact as investors adjust their crypto portfolios in anticipation of September’s meeting. Historically, aligned alterations in fiscal policy and rate predictions have intensified discussions surrounding the broader economic conditions’ effects on digital currencies. These discussions align with the macroeconomic backdrop set by the Federal Reserve’s possible rate changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-decision-crypto-impact-6/