- Guy Young of Ethena Labs addresses meme coin valuation limits.

- Focus on TradFi integration for stablecoin expansion.

- Market dynamics influenced by capital and regulatory shifts.

Ethena Labs founder Guy Young expressed concerns over meme coin market valuation on July 25, suggesting a limited capital pool could hinder future growth.

The commentary highlights the strategic pivot towards integrating traditional finance, targeting institutional investors beyond retail-driven, volatile crypto markets, affecting token evaluation and potential investment inflows.

Meme Coin Valuations Hit $1.2 Trillion Ceiling

Guy Young shared insights regarding the valuation ceiling for meme coins, observing their lack of traction beyond past peaks. Young identifies a recurring pattern, with meme coin capitalization seemingly unable to exceed $1.2 trillion across cycles, emphasizing limits imposed by global retail capital.

The call for integration with TradFi underscores a pathway for stablecoins, aiming to leverage unused capital from institutional investors. Young suggests that tangible products with real business models present a blue ocean opportunity, differing from meme projects that lack substance. “While we’ve already seen strong demand for USDtb, we expect GENIUS compliance to empower our partners and holders to confidently and significantly expand its use across new products and platforms,” Young noted.

Market observers acknowledge the viability of Young’s proposal, noting it could signal a shift towards more sustainable ventures in the crypto space.

Ethena Labs’ TradFi Focus to Reshape Crypto Markets

Did you know? Guy Young’s reflections on meme coin ceilings highlight an ongoing trend, as past cycles in 2021 and 2024 also stagnated around the same capitalization mark, suggesting historical constraints on retail-driven valuation highs.

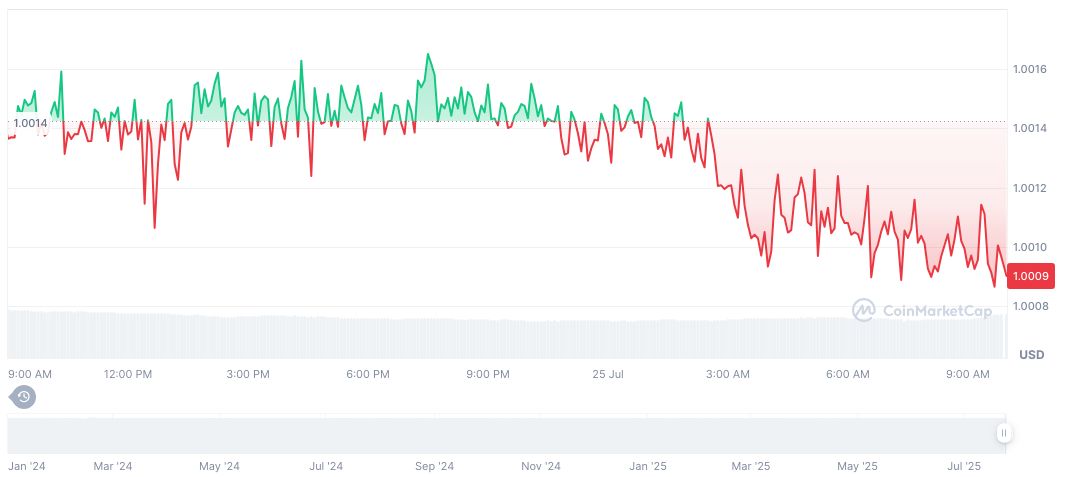

Ethena USDe maintains its price at $1.00, with a market cap of $7.00 billion, as per CoinMarketCap, amid stable trading activity. It ranks prominently among USD-pegged stablecoins, maintaining its value over various periods, despite minor fluctuations.

Based on Coincu research, Ethena Labs’ focus on TradFi could reshape crypto markets by creating stable revenue streams, aligning token valuations with broader financial principles, and reducing reliance on volatile speculative activities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/ethena-labs-tradfi-integration/