- Fed considers recalibrating leverage ratio for large banks.

- Potential enhanced bank activity in U.S. Treasuries.

- Elizabeth Warren warns about potential shareholder benefits.

Federal Reserve Chair Jerome Powell announced on July 22, 2025, at a conference in Washington, D.C., that the Fed is exploring new capital frameworks for large banks.

The decision could affect competition between banks and non-bank institutions globally.

Fed Conference Unveils Potential Bank Leverage Adjustments

The Federal Reserve held a conference on July 22, focused on potential reforms to the capital framework for major U.S. banks. Powell emphasized the Fed’s openness to new ideas and feedback. Vice Chair Bowman mentioned the conference would evaluate the current effectiveness of capital requirements.

A proposal to reduce the enhanced Supplementary Leverage Ratio (eSLR) ratios for large banks was approved on June 27, adjusting the leverage from 5% to between 3.5% and 4.5%. Certain assets, including U.S. Treasuries, may be excluded from these calculations, which could alter banks’ strategies and market activities.

Michelle W. Bowman, Vice Chair for Supervision, Federal Reserve – “The conference will allow for expert discussions on whether capital requirements are operating as intended and the interconnections between different requirements. I look forward to hearing from a broad range of perspectives as we look to the future of capital framework reforms.”

Historical Insights Link Regulatory Shifts to Crypto Movements

Did you know? In the past, major regulatory shifts in bank capital frameworks have occasionally led to increased speculative flows into crypto markets, highlighting the interconnected nature of financial regulations and alternative asset trends.

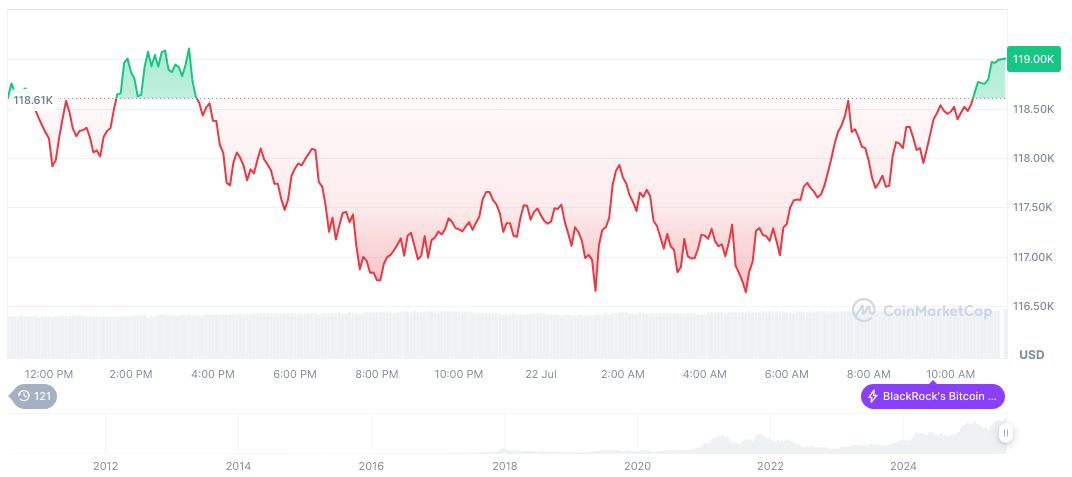

CoinMarketCap indicates that Bitcoin (BTC) is priced at $119,307.30, sporting a market cap of $2.37 trillion with a trading volume up 13.96% reaching $75.87 billion. Bitcoin has shown a 27.24% price increase over the last 90 days, data last updated at 12:50 UTC on July 22, 2025.

Coincu research suggests that the recalibration of bank leverage ratios could encourage more bank participation in the U.S. Treasuries market, which might lead to liquidity shifts affecting both traditional and digital asset markets. Additionally, regulatory changes could shape risk perceptions, indirectly impacting crypto market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350134-fed-eases-capital-requirements/