- Archax acquires Deutsche Digital Assets for EU market expansion.

- Boosts Archax’s regulated service stack across Europe.

- Aims to enhance institutional client services via BaFin licenses.

Archax, a UK-regulated digital asset exchange, announced on July 22 that it would acquire Deutsche Digital Assets, a German-regulated crypto asset management firm managing approximately $70 million in assets.

This acquisition, focused on markets like the UK, Germany, and France, expands Archax’s regulatory licenses, enhancing its ability to serve European institutional clients.

Archax Expands European Market Reach with Key Acquisition

Archax’s acquisition of Deutsche Digital Assets represents a strategic expansion into key European financial markets. The move augments Archax’s regulated service offerings through licenses for portfolio management and investment advisory under the supervision of Germany’s BaFin. CEO Graham Rodford noted, “The deal positions our firm as one of the most comprehensively licensed digital asset firms in Europe.”

Adding Deutsche Digital Assets’ $70 million in assets under management aligns with Archax’s mission to strengthen its market position in Europe. With these new licenses, Archax can offer enhanced investment consultative services, fostering greater trust with European banking and asset management stakeholders.

Industry reactions emphasize the significance of this acquisition. Archax is already known for its partnerships with institutional-grade custodians and compliance providers. Maximilian Lautenschläger, DDA’s Managing Partner, remarked, “The move is a natural fit that opens new market channels on both sides of the channel.”

Previous and Future Strategies in European Markets

Did you know? This acquisition mirrors Archax’s strategy seen in its previous purchase of Spanish broker KSCM in 2023, which also aimed for deeper European market penetration.

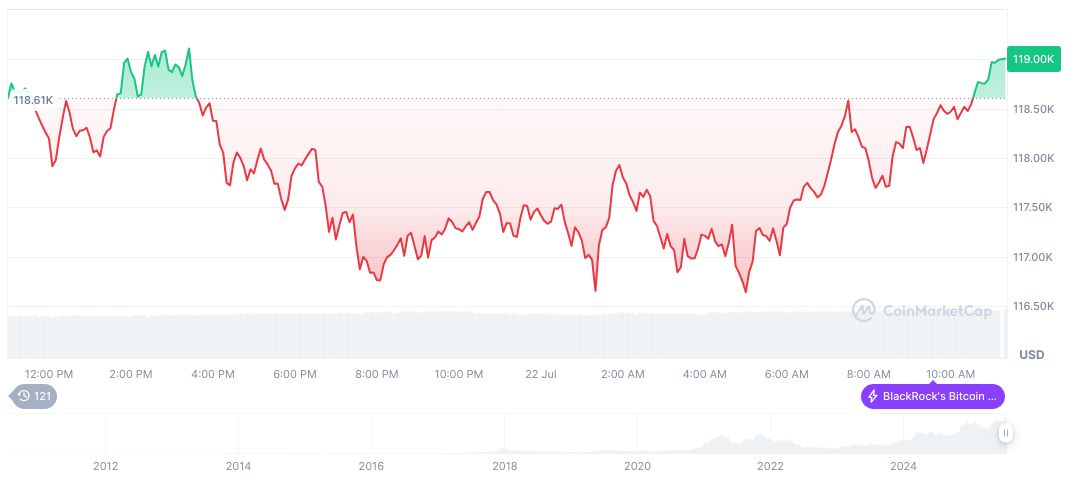

According to CoinMarketCap, Bitcoin (BTC) currently trades at $119,019.38, with a market cap of $2.37 trillion and a 60.32% market dominance. Recent figures show a 15.85% increase in the last 30 days. Trading volumes witnessed a 13.34% change over 24 hours.

Experts from the Coincu research team highlight the acquisition’s potential to accelerate European institutional adoption of digital assets. Historical trends predict that Archax’s expanded regulatory framework will catalyze broader ETPs and asset inflows, fostering robust growth and enhancing liquidity in regional markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350119-archax-acquires-deutsche-digital-assets/