- Western Union explores stablecoins for cross-border remittances, says CEO Devin McGranahan.

- Focus on fast remittances reduces client transaction times.

- Infrastructure tests in Africa improve local currency conversion.

Western Union’s CEO highlights stablecoin potential for enhancing global remittance efficiency.

Western Union, led by CEO Devin McGranahan, announced plans to incorporate stablecoins into its network, as reported on July 22 by Cryptobriefing. This initiative, focusing on programming digital money into remittance processes, may enhance global financial inclusivity.

Western Union Embraces Stablecoins for Faster Remittances

Western Union has strategically shifted towards stablecoins under the leadership of CEO Devin McGranahan. Their move aims to innovate the cross-border payment landscape by enhancing speed and efficiency. McGranahan highlighted their active involvement in improving settlement systems, especially in regions like Africa and South America.

Stablecoin integration marks a significant step for Western Union. The company is making strides in modernizing cross-border payments, which might lead to faster transaction times. This focus aligns with the global trend of adopting digital currencies for smoother financial operations.

“We believe that stablecoins are indeed an opportunity, not a threat. We are already innovating in several places in the world on moving money and settling.” — Devin McGranahan, source

Historical Context and Financial Landscape

Did you know? MoneyGram’s 2022 USDC pilots in South America highlighted similar strategies, emphasizing the shift in remittance giants towards stablecoin adoption to improve financial inclusivity.

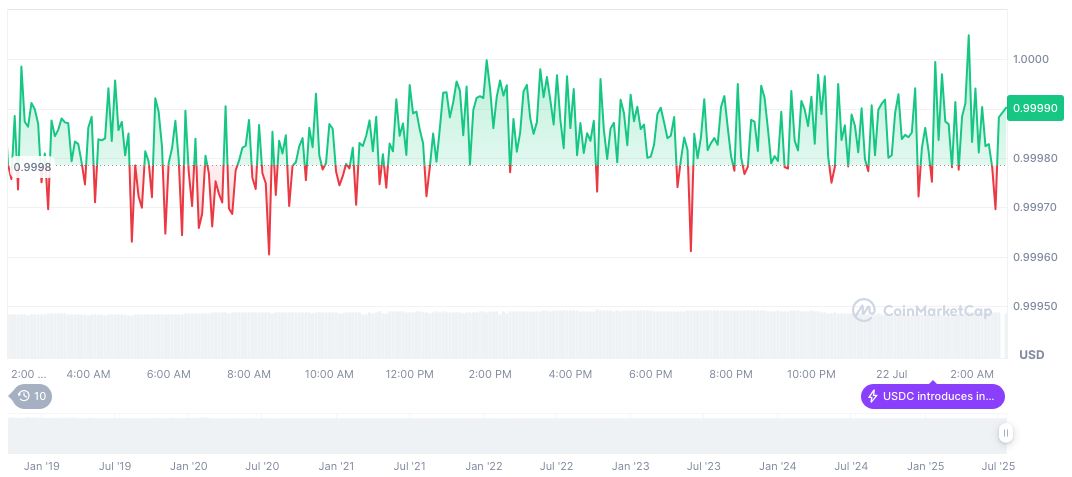

Data from CoinMarketCap shows that USD Coin (USDC) maintains a price of $1.00 with a market cap of $64.69 billion as of July 22, 2025. The stablecoin has seen a 24-hour trading volume of $16.82 billion, marking a minor 1.63% fluctuation.

The Coincu research team suggests that Western Union’s adoption of stablecoins could spearhead further exploration of blockchain solutions in traditional finance sectors. Regulatory frameworks remain pivotal as this integration progresses, potentially redefining remittance dynamics on a global scale. Kraken exchange prepares for IPO in a climate that sees traditional finance aligning more closely with digital innovation, according to internal sources. The digital asset landscape is evolving rapidly as crypto payments company Mesh raises $82M, highlighting the escalating interest and investment in fintech advancements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350017-western-union-stablecoin-remittance/