- Hong Kong begins stablecoin regulation August 1, impacting financial markets.

- Licensing regulation enforces compliance for stablecoin issuers.

- Norman Chan emphasizes stablecoins’ market-stabilizing role.

On August 1, Hong Kong will commence its new stablecoin regulation, allowing dozens of companies to apply for issuer licenses. This initiative, led by the Hong Kong Monetary Authority (HKMA), aims to establish a controlled environment for stablecoins as announced by HKMA Chairman Norman Chan.

The licensing requirements are expected to reshape the stablecoin market by introducing stricter controls and enhancing investor confidence. Dozens of firms are reportedly interested in entering this regulated space, potentially driving growth for Hong Kong’s digital asset ecosystem.

Hong Kong Licenses Fiat-Pegged Stablecoin Issuers Starting August 1

Hong Kong’s move towards stablecoin regulation involves licensing requirements for fiat-pegged stablecoin issuers, beginning August 1. The Hong Kong Monetary Authority will manage the application process, marking a strategic shift in Hong Kong’s digital financial landscape.

Companies aiming to enter the stablecoin market must adapt to new compliance measures set forth by the ordinance. These include rigorous measures such as reserve asset management and investor safeguards. Christopher Hui, Secretary for Financial Services and the Treasury, noted that “after the Ordinance commences operation, the licensing regime will provide suitable guardrails for relevant stablecoin activities. It will be a milestone in facilitating the sustainable development of the stablecoin and digital asset ecosystem in Hong Kong.” Such regulations are likely to draw institutional investors seeking assurance in the digital currency domain.

Norman Chan, at a recent conference, underscored that stablecoins should stabilize the market rather than serve speculative purposes. He emphasized that the digitization of asset markets is a strategic long-term goal, advocating against short-term profit motives. As Chan stated, “Stablecoins should not be speculative instruments. The digitization of asset markets is a long-term strategic move, and stablecoins should play a stabilizing role. One should not have a short-term perspective. Hong Kong’s current development pace is among the leading group in other financial centers.”

Stablecoins to Stabilize Markets, Says HKMA’s Norman Chan

Did you know? Hong Kong’s stablecoin regulation may mirror effects witnessed in the EU with MiCA, where regulatory clarity spurred increased institutional engagement in digital assets.

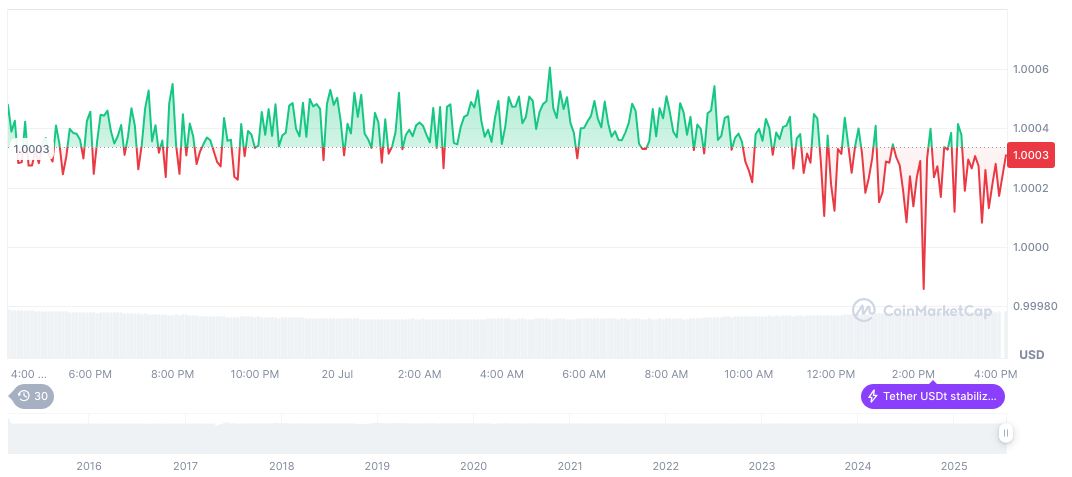

As per CoinMarketCap, Tether USDt (USDT) remains stable at $1.00, holding a market cap of approximately $161.62 billion. It sees trading volumes of $111.87 billion, experiencing modest price fluctuations over recent periods. Updated trading data as of July 20, 2025, reveal market trends across various intervals, showing minimal volatility.

Expert insights from Coincu suggest that Hong Kong’s regulatory framework may encourage market stability and innovation. By providing a clear legal framework, it is expected to attract international participation, fortifying its position as a leading global financial center.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349781-hong-kong-stablecoin-regulation-2025-4/