- Yang and Xu orchestrated an illegal stablecoin transfer network using USDT for cross-border funds amounting to approximately 6.5 billion yuan over three years.

- Regulatory implications are apparent, with the crackdown reflecting a push to enforce legal financial channel compliance.

- Absence of public statements from key opinion leaders or market influencers suggests a focused legal and regulatory handling of the case.

Yang and Xu orchestrated an illegal stablecoin transfer network using USDT for cross-border funds amounting to approximately 6.5 billion yuan over three years. They utilized shell companies to facilitate these transactions. Both domestic and overseas clients engaged in the exchange, revealing the scale of the operation.

Regulatory implications are apparent, with the crackdown reflecting a push to enforce legal financial channel compliance. The broader ramifications involve increased scrutiny of stablecoin usage in cross-border exchanges, prompting discourse on potential regulatory changes, which can be seen in the Treasury Report on Stablecoins – November 2022.

Heightened Regulatory Scrutiny and Market Impact

Absence of public statements from key opinion leaders or market influencers suggests a focused legal and regulatory handling of the case. Major industry voices have not yet reacted to this enforcement, keeping public discourse relatively muted, as noted in Gensler’s Remarks on Crypto Markets at SEC.

Regulatory implications are apparent, with the crackdown reflecting a push to enforce legal financial channel compliance. The broader ramifications involve increased scrutiny of stablecoin usage in cross-border exchanges, prompting discourse on potential regulatory changes.

Absence of public statements from key opinion leaders or market influencers suggests a focused legal and regulatory handling of the case. Major industry voices have not yet reacted to this enforcement, keeping public discourse relatively muted.

Market Reactions and Future Implications

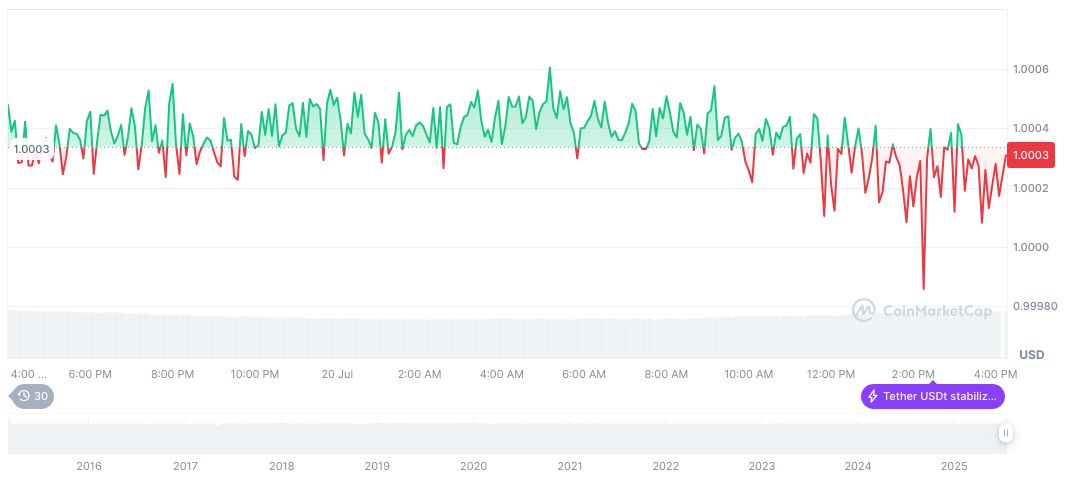

Did you know? The use of stablecoins like USDT has surged in recent years, often being utilized for cross-border transactions due to their perceived stability compared to traditional cryptocurrencies.

Market analysts are closely monitoring the situation, as the crackdown could lead to significant shifts in trading volumes and regulatory frameworks surrounding stablecoins.

Experts suggest that this case may set a precedent for future enforcement actions against similar operations, potentially reshaping the landscape of cryptocurrency regulations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349762-shanghai-stablecoin-crackdown-usdt/