- Yang and Xu sentenced for illegal Tether exchanges totaling 6.50 billion yuan.

- Evaded supervision by splitting cross-border transactions into separate operations.

- China’s regulatory crackdown on crypto continues, with deterrence strategies strengthening.

Shanghai’s Pudong New Area People’s Court concluded a significant case involving illegal cross-border cryptocurrency exchanges on July 16, made public on July 20, 2025. The court sentenced individuals, including Yang and Xu, for facilitating 6.5 billion yuan in Tether transactions from domestic shell companies.

“This illegal exchange mechanism splits foreign exchange transactions that should be under regulatory oversight into two independent operations, thereby evading supervision,” said Gao Yongfeng, Senior Partner at Shanghai Jinli Law Firm.

Shanghai Court Tackles $6.5 Billion Tether Transactions

Despite the 2021 ban on crypto trading in China, the case illustrates the persistent underground demand for stablecoin remittances. The proceedings highlight China’s ongoing effort to curb cryptocurrency-based capital flight and enforce strict regulatory oversight.

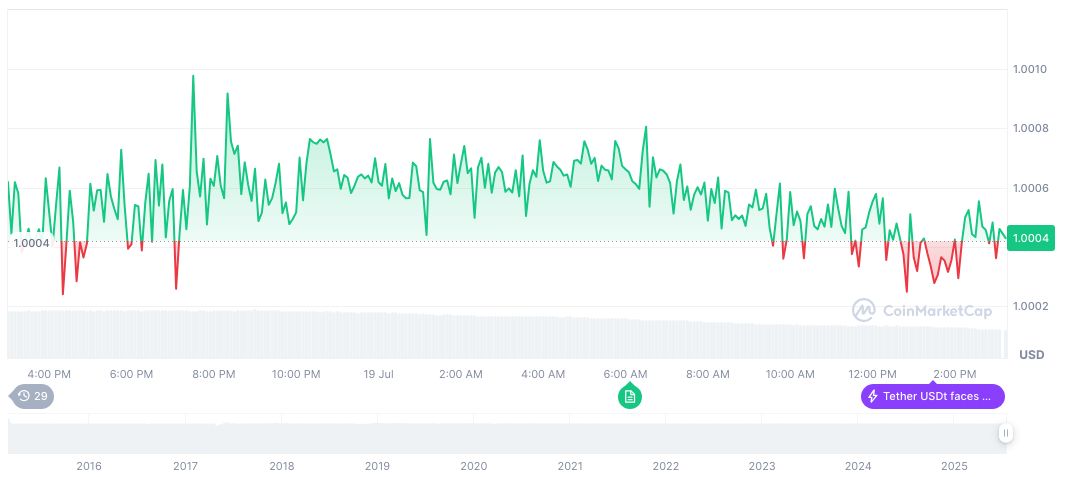

Currently, Tether (USDT) is valued at $1.00, holding a market cap of approximately $161.62 billion, according to CoinMarketCap. It commands 4.18% of the market. The 24-hour trading volume stands at $82.73 billion, marking a 50.20% decline. Tether’s price remains stable despite the case’s publicity.

According to Coincu research, enforcement actions like those against Yang and Xu could guide future technological and policy adaptations. By intensifying regulatory measures, authorities target to dismantle illicit financial frameworks globally interconnected by cryptocurrencies.

Ongoing Challenges in China’s Crypto Regulation

Did you know? The global cryptocurrency market has seen significant fluctuations, with regulatory responses playing a crucial role in shaping its landscape.

Currently, Tether (USDT) is valued at $1.00, holding a market cap of approximately $161.62 billion, according to CoinMarketCap. It commands 4.18% of the market. The 24-hour trading volume stands at $82.73 billion, marking a 50.20% decline. Tether’s price remains stable despite the case’s publicity.

According to Coincu research, enforcement actions like those against Yang and Xu could guide future technological and policy adaptations. By intensifying regulatory measures, authorities target to dismantle illicit financial frameworks globally interconnected by cryptocurrencies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349653-shanghai-court-crypto-exchange-tether/