- GENIUS Act ends yield-bearing stablecoins, impacting DeFi and market strategies.

- Ethereum DeFi could benefit from migrating capital.

- US-based issuers face stricter regulatory frameworks.

President Donald Trump has signed the GENIUS Act, effectively banning yield-bearing stablecoins in the US. This new regulation came into effect as of July 19, 2025.

The GENIUS Act is expected to significantly impact US dollar-denominated stablecoins, shifting focus towards decentralized finance (DeFi) solutions.

GENIUS Act Outlaws Yield-Bearing Stablecoins in U.S.

The GENIUS Act, signed into law by President Trump, prohibits yield-bearing stablecoins in the US. This legislative move limits US-based entities from offering yield on stablecoins without full regulatory authorization, affecting both institutions and retail investors. Cryptocurrency analyst Nic Puckrin noted the potential for Ethereum-based DeFi to attract investors as an alternative source of passive income. Christopher Perkins, President of CoinFund, remarked, “The dollar is a non-yielding depreciating asset. DeFi is precisely where you can earn yield to preserve value. Therefore, I believe the summer of stablecoins will turn into the summer of DeFi.” Opinions suggest a potential rotation into DeFi ecosystems like Ethereum, Aave, and Compound.

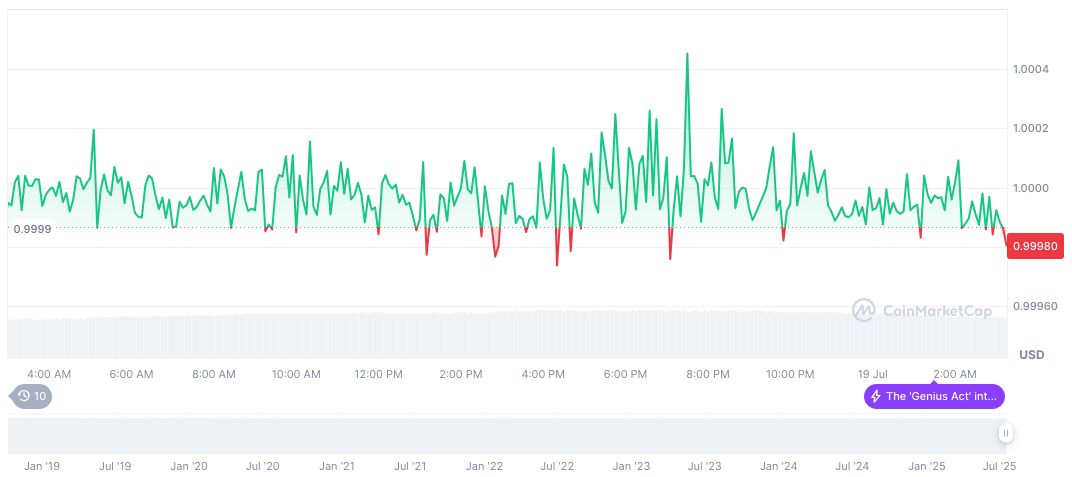

According to CoinMarketCap, USDC maintains a price at $1.00, a market cap of 64,787,636,655, and a market dominance of 1.68%. In the last 24 hours, USDC traded 24,500,315,088 with a negative price change of 1.00%. No price changes exceeded 1% over the previous 90 days.

The research team at Coincu suggests that as regulatory clarity increases, compliant frameworks may attract more institutional investment while pushing non-compliant yield-bearing products out of US markets. Historical trends indicate a potential rise in DeFi protocol TVL as users seek on-chain yield alternatives.

Ethereum and DeFi Positioned for Incoming Capital Movement

Did you know? Historically, major regulatory changes, such as the GENIUS Act, have driven liquidity towards decentralized financial solutions, highlighting the resilient adaptability of DeFi protocols in preserving investor value.

According to CoinMarketCap, USDC maintains a price at $1.00, a market cap of 64,787,636,655, and a market dominance of 1.68%. In the last 24 hours, USDC traded 24,500,315,088 with a negative price change of 1.00%. No price changes exceeded 1% over the previous 90 days.

The research team at Coincu suggests that as regulatory clarity increases, compliant frameworks may attract more institutional investment while pushing non-compliant yield-bearing products out of US markets. Historical trends indicate a potential rise in DeFi protocol TVL as users seek on-chain yield alternatives.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349510-genius-act-bans-stablecoin-yields/