- Bullish, backed by Block.one and major investors, aims for NYSE IPO.

- $1.25 trillion trading volume since launch declared.

- Impact anticipated for Bitcoin and EOS markets.

Block.one’s Bullish plans to list on the New York Stock Exchange with an IPO under the ticker “BLSH” as announced recently. The firm named Tom Farley, a former NYSE president, as its CEO.

Bullish’s public market entry aims to enhance credibility, benefiting Bitcoin and EOS. With trading volumes of 1.25 trillion dollars declared, it highlights strong financial backing.

Bullish Pursues $1.25 Trillion Exchange Volume NYSE Listing

Bullish files for an IPO in the United States, targeting a New York Stock Exchange listing. The move comprises a comprehensive strategy by its parent company, Block.one, supported by significant investments from Founders Fund, Thiel Capital, and other notable backers. Tom Farley, Bullish’s CEO, brings valuable experience having held a leadership position at the NYSE. The company’s filing with the SEC is a bold step aligning its operations with regulatory requirements.

The IPO initiative highlights Bullish’s potential role in increasing the adoption and integration of stablecoins and blockchain technology. The exchange seeks to leverage strong institutional backing while navigating competitive waters against established players like Binance and Coinbase.

“With a robust treasury of $874 million in cash and $2.4 billion in customer assets, we are positioned well for future growth.” — Tom Farley, CEO, Bullish

Reactions from market participants stress the significance of Bullish’s move in driving further institutional interest in cryptocurrency trading platforms. Industry leaders view this development as an indication of the maturation of crypto-financial markets, opening doors for increased mainstream acceptance and participation.

Bitcoin and EOS Markets Set for Transformation with Bullish IPO

Did you know? Bullish’s attempt to list on the NYSE marks a follow-up to their previously abandoned SPAC route in 2022, highlighting continued regulatory pursuit and market strategy recalibration.

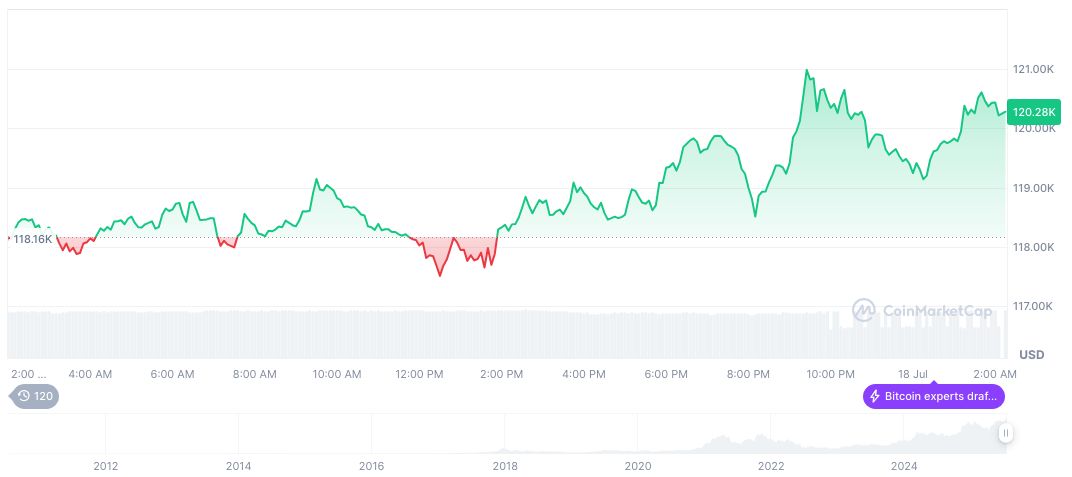

According to CoinMarketCap data, Bitcoin (BTC) trades at $118,094.87, maintaining a market dominance of 61.05% with a market cap of approximately $2.35 trillion. Over the past 90 days, its price surged by 38.54%. Current volume shows a significant 52.78% rise, reflecting vibrant trading activity.

Experts from Coincu highlight potential shifts in how institutional capital interprets crypto exchanges, especially those pursuing public listings. As Bullish solidifies its operational framework, the focus on compliance and transparency is expected to set precedents within evolving crypto-regulatory landscapes globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349502-bullish-ipo-nyse-listing-planned/