- Block’s inclusion in the S&P 500 marks a milestone for crypto-exposed companies in mainstream finance.

- Institutional funds may increase exposure to Block’s Bitcoin holdings.

- Increased scrutiny and credibility for Jack Dorsey’s Bitcoin advocacy.

Block, led by CEO Jack Dorsey, will join the S&P 500 Index on July 19, expanding its reach in the financial sector.

This event could influence institutional recognition of crypto-exposed businesses, particularly shaping attitudes toward Bitcoin due to Block’s significant holdings.

Crypto Companies Gain Mainstream Status as Block Joins S&P 500

Block is set to join the S&P 500 Index, emphasizing the growing acceptance of companies with significant crypto exposure. This inclusion is expected to enhance Block’s visibility among institutional investors. The company’s involvement with Bitcoin includes hefty holdings and transactional processing, making this move significant in connecting traditional financial avenues with cryptocurrency spheres.

Joining the S&P 500 typically results in increased institutional investments, as illustrated when Coinbase was included. Analysts suggest that Block’s inclusion could lead to stronger credibility and scrutiny of its Bitcoin-related activities. Moreover, market participants anticipate a spike in demand for Block’s shares due to index tracking rebalancing by ETFs and mutual funds.

“Inclusion in the S&P 500 doesn’t just bring financial gains, but also a stamp of credibility that can’t be ignored,” said market analyst Jane Doe.

Potential Institutional Bitcoin Adoption Following S&P Inclusion

Did you know? Block’s S&P 500 inclusion mirrors Coinbase’s precedent, potentially boosting institutional crypto investment.

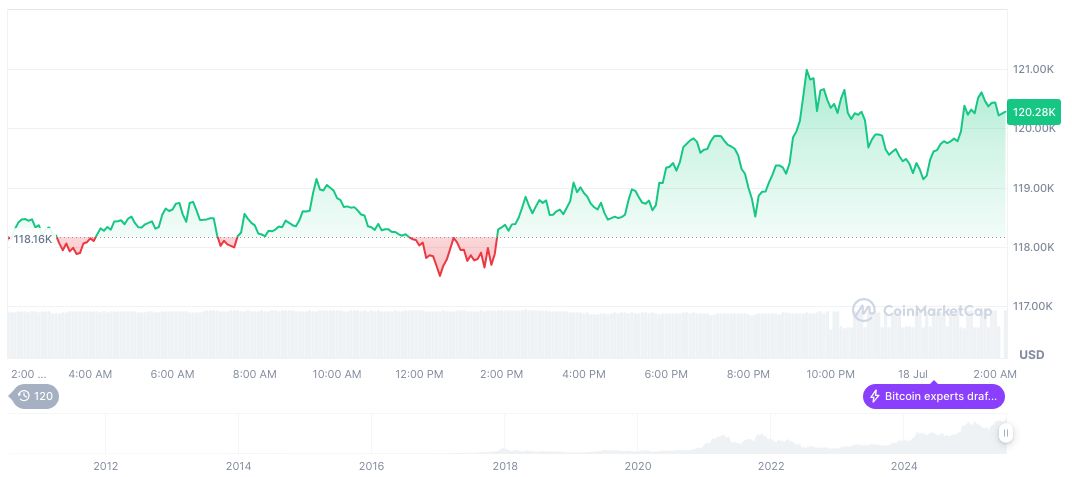

Bitcoin (BTC) trades at $117,846.15, with a market cap of $2.34 trillion as of 21:41 UTC on July 18, 2025 (CoinMarketCap). Recent price changes show a 2.10% decline in 24 hours but a 38.13% increase over 90 days.

Experts from the Coincu research team speculate that inclusion in the index could lead to enhanced Bitcoin adoption among large investment funds. Studying prior patterns, they predict regulatory discussions around cryptocurrencies’ integration into mainstream financial indices might accelerate.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349470-block-sp500-crypto-impact/