- Trump signs GENIUS Act, solidifying U.S. cryptocurrency framework.

- Historic crypto regulation supports stablecoin institutional use.

- Immediate response: EMPHASIS on stablecoin market legitimacy.

Donald Trump has signed the GENIUS Act into law at the White House on July 18, positioning it as a pivotal cryptocurrency legislative step for the U.S.

The GENIUS Act establishes a standardized regulatory environment for stablecoins, enhancing their legal recognition and use in the U.S financial ecosystem.

Trump’s Landmark Move Shifts U.S. Crypto Regulation

Trump’s action marks a watershed in U.S. cryptocurrency policy. The law aims to provide clear regulatory guidelines for stablecoins, especially those pegged to the U.S. dollar. Bo Hines, leading Trump’s Digital Asset Advisory Committee, facilitated its progression, marking a significant pivot in Trump’s previous crypto stance.

Consequently, bold transformations in regulatory landscapes are anticipated. The U.S. stablecoin market‘s newfound clarity may encourage broader adoption and integration into traditional financial systems, likely fostering trust among institutional players and boosting operational viability.

Some political figures expressed concerns regarding potential repercussions. Rep. Marjorie Taylor Greene raised alarms over centralized digital currencies, stating:

This bill regulates stablecoins and provides for the backdoor Centralized Bank Digital Currency. The Federal Reserve has been planning a CBDC for years and this will open the door to move you to a cashless society and into digital currency that can be weaponized against you by an authoritarian government controlling your ability to buy and sell. Do you actually trust your government to never do that to you? I don’t.

Criticism or approval varied, manifesting stark divides in policy outlooks. Trump’s statement on Truth Social underscored legislative achievements, framing criticism as counterproductive.

Stablecoin Framework Set to Influence Global Policy

Did you know? The GENIUS Act aligns with international crypto legislative moves, similar to the EU’s MiCA, enhancing stablecoin industry legitimacy and compliance frameworks.

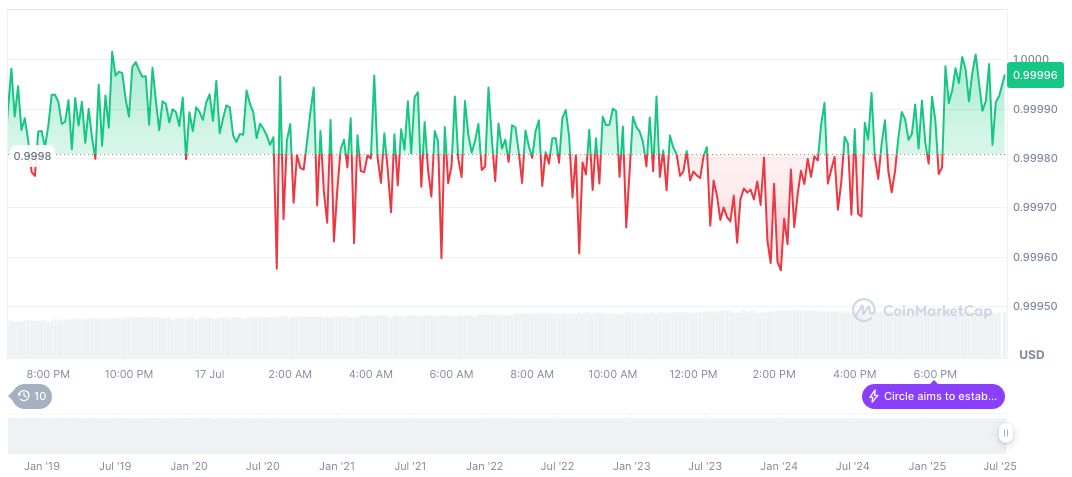

USDC, a major stablecoin, remains at $1.00, backed by a market cap of $64.44 billion and trading volume showing a 40.11% increase to $28.01 billion in the last 24 hours. CoinMarketCap reports a stable supply of 64.45 billion tokens with negligible recent price shifts across months.

Coincu analysts suggest this law may precipitate further regulatory frameworks, potentially fostering innovation in digital finance. Evaluating historical precedents, similar regulations abroad have led to increased compliance, influencing tech developments and market behaviors.

Moreover, analyzing global impact, some see the U.S. move as a step towards a larger role in digital currency leadership, which could set a precedent for other nations. Further regulatory developments could be comparable to those in the EU as noted by Coincu.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349433-trump-signs-genius-act-crypto-law/