- University of Michigan’s consumer sentiment up to 61.8 in July.

- Affects risk asset performance, including BTC and ETH.

- No official statements from key financial leaders yet.

BlockBeats News reported that the preliminary reading of the US July University of Michigan Consumer Sentiment Index was 61.8, surpassing the expected value of 61.5.

The unexpectedly higher reading suggests consumer resilience, potentially supporting risk assets like BTC and ETH. Market dynamics could shift, impacting financial strategies.

University of Michigan Index Surpasses July Projections

The University of Michigan reported an increase in consumer sentiment, with July’s preliminary index sitting at 61.8. This higher-than-expected figure follows a previous reading of 60.7.

Higher sentiment may boost investor confidence, creating a more risk-seeking environment. Such conditions typically signal potential gains for BTC, ETH, and other leading cryptocurrencies.

As of July 18, 2025, there are no available quotes from key players, leadership, or crypto KOLs related to the July Consumer Sentiment Index data. Therefore, no direct citations or statements can be provided in the requested format. The summary indicates that neither the University of Michigan, Federal Reserve, regulatory bodies, nor prominent figures in the cryptocurrency space have commented on this data or its implications.

Crypto and Market Implications Considered Amid Positive Sentiment

Did you know? In past instances where the University of Michigan Consumer Sentiment Index surpassed expectations, risk assets typically saw modest gains short-term. A historical comparison reveals this pattern.

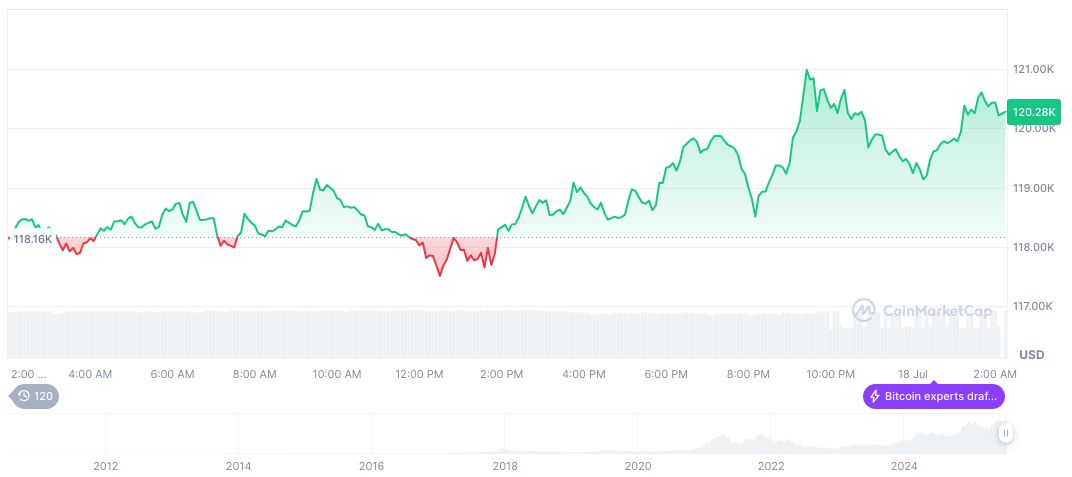

Bitcoin’s current price is $119,250.56 with a market cap of $2.37 trillion, according to CoinMarketCap. Recent price movements show a 0.82% increase over 24 hours and a 39.54% increase over 90 days.

Coincu notes that the elevated sentiment index might support short-term crypto investment if followed by positive consumer data. Long-term impacts depend on sustained economic growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349426-us-consumer-sentiment-index-july-2025/