The next price trajectory for Bitcoin is shrouded in uncertainty, as Peter Brandt has identified that Bitcoin is at a critical junction.

“Which way will the Banana Split?” Brandt asked in an X post on Friday. An accompanying chart shows that Bitcoin is now at a critical price level, and its price reaction will determine the next phase of its near-term price action.

Bitcoin Reaches Banana Chart Resistance

A few days earlier, Brandt had highlighted that the entire price of Bitcoin could be described with a single fruit—a banana. Notably, this price structure engulfed the crypto firstborn’s price action dating back to 2010, with prices repeatedly shifting between its top and bottom.

Interestingly, each bull cycle has followed a parabolic trendline, resuming an uptrend after a period of price correction from the previous season’s top. Notably, Bitcoin has followed the same pattern this cycle, rising from a price bottom of $15,560 after the FTX implosion in November 2022 to its current all-time high of $123,141. Now, Bitcoin trades for $120,401 after a mild pullback.

At this stage, the price of Bitcoin is at a crucial resistance level, aligning with the top of the Banana chart, and Brandt is wary of its next move. The veteran analyst suggested that Bitcoin could split in two directions, either upwards to new price discoveries or downwards to retest previous prices.

Meanwhile, as a typical Banana chart and with Bitcoin’s previous reaction to the top of the pattern in previous cycles, prices could go sideways from here. Nonetheless, this remains uncertain, as many suggest that this cycle is different from previous ones due to institutional influx and an imminent supply shock.

Recall that Brandt earlier noted the possibility of a crash to $27,000, citing a recurring price action from the 2021 cycle. However, he flipped bullish a few weeks later, predicting that BTC could reach $150,000 in August.

Difficult for Bitcoin to Fall Below $100,000

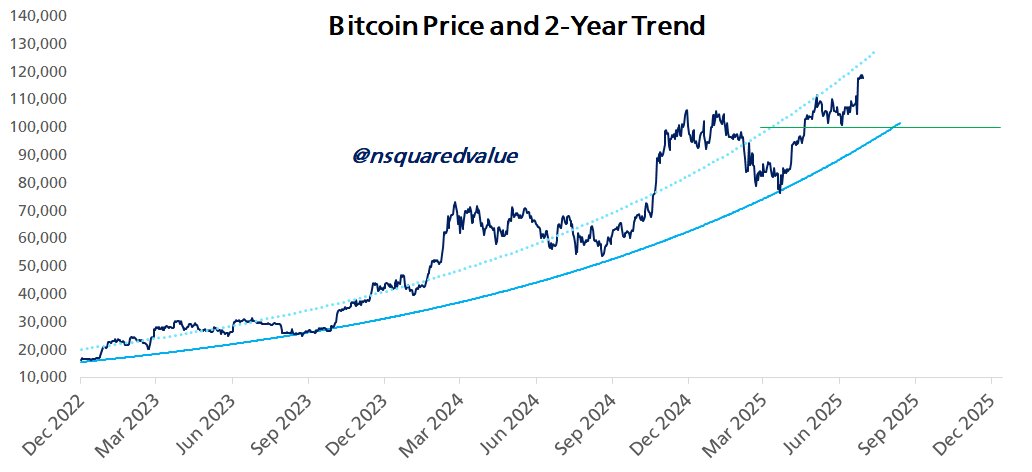

Meanwhile, if things go sideways for Bitcoin, it would be difficult to fall below the six-figure price mark, according to analyst Timothy Peterson. He shared this analysis in a July 17 post, drawing context from the 2-year price trend.

An accompanying chart shows Bitcoin’s price trend along with the super 2-year trend support. Bitcoin has previously held its own at each visit to the trendline, as seen during the lows of $25,000 between August and September 2023, and the sharp correction in April, which brought the price down to $74,000.

Meanwhile, the 2-year support trendline has now reached the $100,000 price mark, marking strong support for the pioneering cryptocurrency. Citing this, Peterson has argued it would be difficult for Bitcoin to drop below $100,000.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/07/18/peter-brandt-says-bitcoin-banana-chart-is-about-to-split-whats-next/?utm_source=rss&utm_medium=rss&utm_campaign=peter-brandt-says-bitcoin-banana-chart-is-about-to-split-whats-next