- The seminar focused on stablecoin regulation and digital asset transformation.

- Major financial and regulatory players participated.

- Implications for stablecoin policy and industrial asset integration.

The China Industrial Internet Research Institute convened a seminar on July 18 to discuss stablecoin policies and industrial digital asset regulation, attended by MIIT representatives.

This event highlights strategic coordination by major institutions to explore regulatory frameworks for stablecoins and industrial internet integration in China.

China’s Regulatory Seminar: Insights and Attendee Impact

Held by the China Industrial Internet Research Institute, the seminar reviewed stablecoin policies and industrial asset integration. Representatives from MIIT, alongside financial entities such as Guosen Securities and SoftBank Asia Venture Capital, were present.

No official changes to China’s existing stablecoin regulations were made public at the seminar. Discussions centered on potential frameworks and guidelines to harmonize digital asset adoption with industrial internet strategies.

Though official statements from government or financial leaders were absent, the presence of key stakeholders indicates ongoing interest in regulated digital asset environments. “Policy guidance for compliant, regulated digital asset adoption in industrial contexts,” stated the Ministry of Industry and Information Technology.

Digital Yuan Precedents and Stablecoin Market Dynamics

Did you know? China’s prior events focused on digital yuan and blockchain integration set precedents for exploring regulated digital currencies in supply chain management.

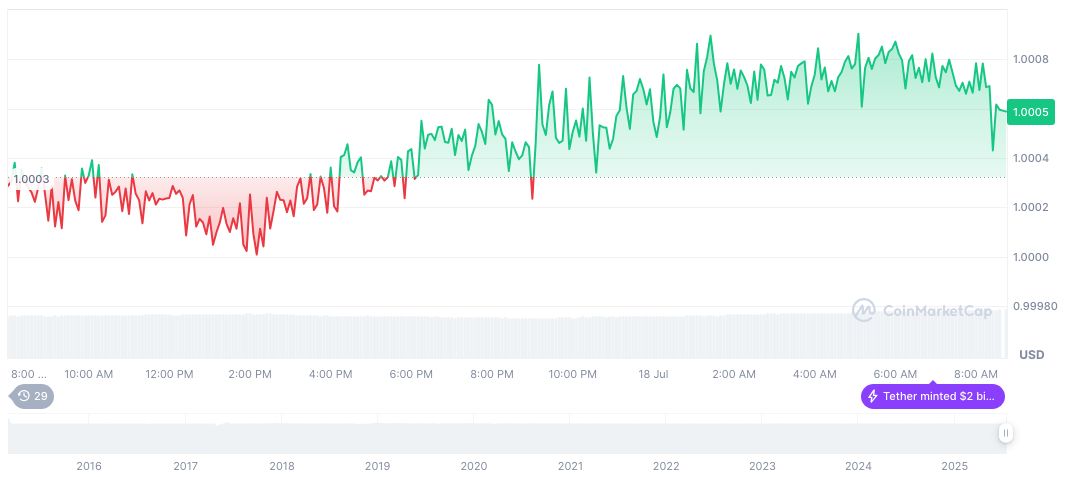

According to CoinMarketCap, Tether USDt (USDT) trades at $1.00, with a market cap of $160.36 billion, showing a 24-hour trading volume surge to $166.70 billion—a 13.23% increase, highlighting USDT’s enduring role as a stable crypto asset.

Coincu analysts foresee financial innovations stemming from this seminar potentially enhancing industrial internet deployment. The integration of stablecoins in supply chains could improve efficiency and policy alignment over time.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349356-china-stablecoin-digital-asset-seminar/