- President Trump proposes expanding 401k options to include cryptocurrencies and other alternative assets.

- The executive order could remove existing regulatory barriers, fostering a diversified retirement portfolio.

- The initiative reflects a significant shift in investment strategies and regulatory approaches.

Trump’s Executive Order to Revolutionize U.S. Retirement Market

According to the Financial Times, President Trump is pushing for an executive order to open 401k retirement plans to alternative assets like cryptocurrencies, gold, and private equity. This executive action is expected to direct regulators to address barriers in current regulations, enhancing investment opportunities. Previously, the Trump administration facilitated investment in crypto assets by relaxing restrictions on retirement account allocations and sponsoring related legislation.

Potential Market Shift Could Grant Investors Access to Cryptocurrencies

If implemented, the potential market shift could grant investors access to cryptocurrencies and other assets, expanding their retirement portfolios. Including such assets could also stimulate new demand from within the traditional investment community.

While no official statements from prominent figures involved in this initiative have been released, the crypto community is abuzz with speculation. The initiative may potentially lead to increased cryptocurrency trading activity, reflecting anticipatory optimism within the market. Despite the speculative reports, it remains crucial to await official confirmations.

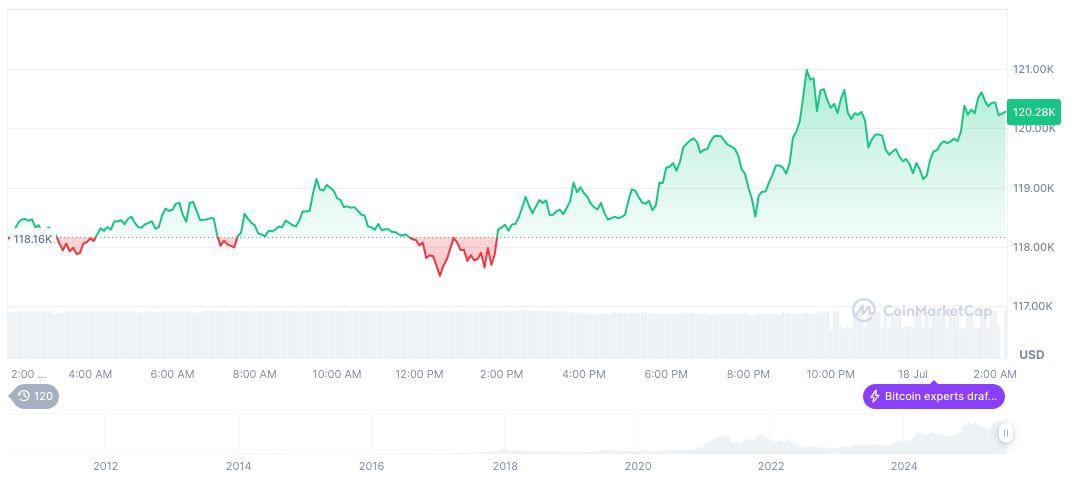

According to CoinMarketCap, Bitcoin (BTC) trades at $120,229.85 with a market cap of $2.39 trillion and dominates 60.64% of the market. The previous 24-hour trading volume reached $50.27 billion, a 29.89% decrease. Meanwhile, BTC’s value has risen by 1.84% over the last 24 hours and 41.54% over 90 days.

Market Data and Expert Insights

Did you know? Despite the lack of official confirmation, the mere possibility of integrating cryptocurrencies into 401k plans has sparked curiosity, drawing comparisons to earlier legislative pushes under Trump’s administration.

The Coincu research team suggests that broadening retirement portfolio options might advance financial product diversification. Mark Uyeda, Acting Chairman of the SEC, expressed the need for regulatory clarity, stating, “The focus will be on creating clear regulations that benefit both consumers and the market.” Such regulatory shifts could enhance cryptocurrency’s role within mainstream investment strategies, fostering wider acceptance and innovation in financial offerings.

The Coincu research team suggests that broadening retirement portfolio options might advance financial product diversification. Mark Uyeda, Acting Chairman of the SEC, expressed the need for regulatory clarity, stating, “The focus will be on creating clear regulations that benefit both consumers and the market.” Such regulatory shifts could enhance cryptocurrency’s role within mainstream investment strategies, fostering wider acceptance and innovation in financial offerings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349330-trump-401k-crypto-inclusion/