- Fed Governor Quarles emphasizes keeping interest rates steady amid tariff-induced inflation.

- Tariff impacts contribute to inflation; rate cuts deemed unnecessary.

- Maintaining controlled inflation expectations central to Fed’s current policy.

The impact of tariffs, according to Quarles, is influencing consumer prices, prompting a reconsideration of rate cuts. The Fed’s approach underscores its focus on stabilizing economic factors without reducing rates at this juncture, ensuring controlled inflation that aligns with broader monetary goals. As Randal Quarles stated, “We are committed to maintaining low interest rates and ongoing quantitative easing until ‘substantial further progress’ is achieved in employment and inflation goals.”

Federal Reserve Governor Randal Quarles highlighted on Thursday that interest rates should remain unchanged for the time being. This statement comes as the Trump administration’s tariffs are beginning to affect consumer prices. The Fed is focusing on managing inflation expectations through more stringent monetary policy measures.

Digital Asset Market Watches Fed’s Interest Rate Strategy

Federal Reserve Governor Randal Quarles emphasized the importance of maintaining current interest rates despite the ongoing impact of tariffs on consumer prices. His statement reflects the Fed’s commitment to controlling inflation and avoiding premature rate cuts. Interest rate stability is crucial as inflationary effects from tariffs begin to manifest. The central bank aims to tighten monetary policy while carefully monitoring future shifts. Market analysts and economic advisors view this stance as a necessary step to ensure economic stability. Key figures in financial sectors acknowledge Quarles’ assessment and its potential implications for monetary strategy.

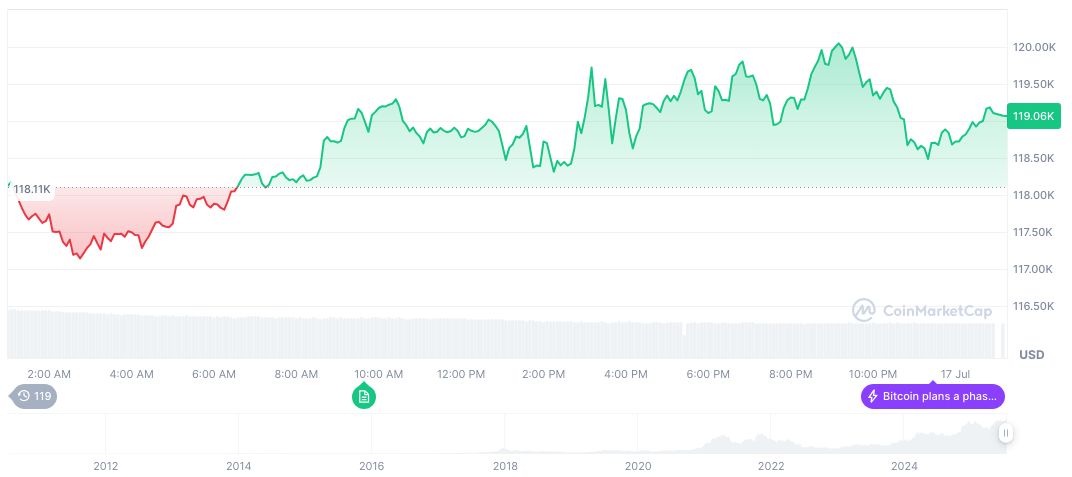

Data from CoinMarketCap indicates Bitcoin (BTC) currently prices at $118,718.15, marking a 0.27% increase over 24 hours. Its market cap stands at formatNumber(2361735800338.81, 2) with a 61.74% dominance. The 24-hour trading volume slightly decreased by 5.50% to $71,033,199,505.64. BTC’s price rose 6.78% in the last 7 days, reflecting notable market activity.

Coincu research team suggests that continued focus on interest rates could lead to incremental regulatory and financial shifts in digital assets. As the Fed prioritizes financial system stability, potential innovations in the cryptocurrency sector may arise, leading to both challenges and opportunities.

Market Data Overview

Did you know? The Federal Reserve’s decisions on interest rates can significantly influence cryptocurrency markets, as investors often react to changes in monetary policy.

Data from CoinMarketCap indicates Bitcoin (BTC) currently prices at $118,718.15, marking a 0.27% increase over 24 hours.

As Randal Quarles stated, “We are committed to maintaining low interest rates and ongoing quantitative easing until ‘substantial further progress’ is achieved in employment and inflation goals.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349214-fed-quarles-interest-rate-stability/