- U.S. House progresses crucial crypto legislation, affecting market and regulatory landscape.

- Strengthened bipartisan support may ban federal CBDCs.

- Regulatory clarity likely boosts digital asset market confidence.

House Republican leaders, including Steve Scalise and Tom Emmer (R-Minn.), guided these bills through to this final stage. These bills address market structures for digital assets, stablecoin regulation, and a possible federal CBDC ban, as emphasized by Chairman French Hill and former President Donald Trump‘s interventions. Bipartisan support is anticipated, which could reshape the U.S. digital asset landscape.

Passage of these bills promises enhanced regulatory clarity, a long-sought goal within the market. This clarity may spur new financial opportunities, such as increased venture capital inflows and stability for platforms dealing with cryptocurrencies such as BTC, ETH, and stablecoins. Market sentiment has noted a positive uplift, reflecting optimism toward these legislative advancements.

Bitcoin and Market Dynamics Amid Regulatory Changes

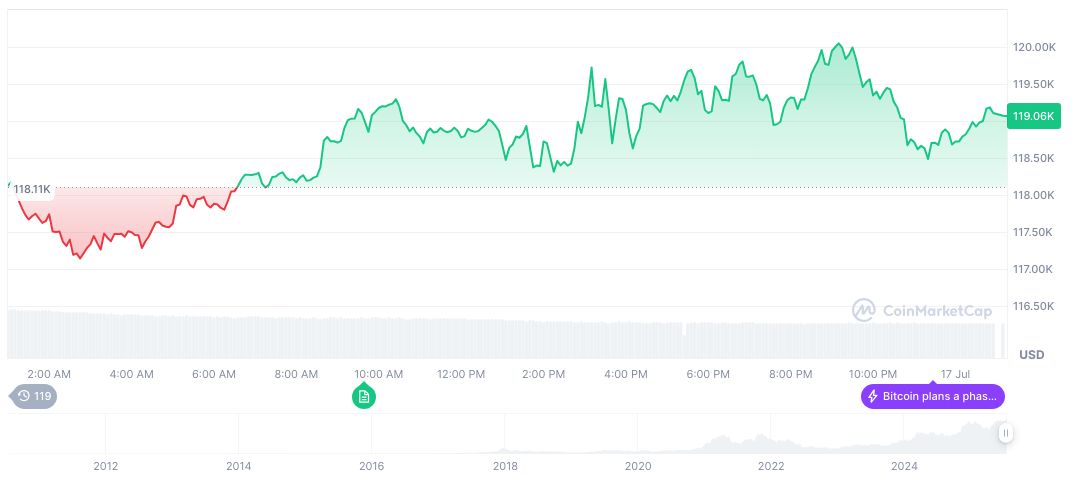

As of the latest update, Bitcoin (BTC) stands at a price of $118,193.34, according to CoinMarketCap. Its market cap is reported at $2.35 trillion, commanding a 62.18% market dominance. Despite a 24.17% drop in 24-hour trading volume, Bitcoin’s value has increased by 0.72% over the same period. Over the past 90 days, BTC has seen substantial growth of 39.39%.

Research from Coincu projects that these legislative changes will likely bolster institutional confidence in the market. Historical data shows that clarified regulatory frameworks can lead to heightened activity and investment in digital assets, particularly during periods of governmental focus on innovation in the sector.

We’re bringing all of them… We’re back on track. And exactly what the combination will be, we’re talking through that, but all three bills will be encompassed in the work we do today. — Steve Scalise, House Majority Leader, U.S. House of Representatives

Bitcoin and Market Dynamics Amid Regulatory Changes

Did you know? Market structure reforms in digital assets often trigger wider market movements, similar to those seen during early regulatory discussions such as the Biden-era executive orders.

As of the latest update, Bitcoin (BTC) stands at a price of $118,193.34, according to CoinMarketCap. Its market cap is reported at $2.35 trillion, commanding a 62.18% market dominance. Despite a 24.17% drop in 24-hour trading volume, Bitcoin’s value has increased by 0.72% over the same period. Over the past 90 days, BTC has seen substantial growth of 39.39%.

Research from Coincu projects that these legislative changes will likely bolster institutional confidence in the market. Historical data shows that clarified regulatory frameworks can lead to heightened activity and investment in digital assets, particularly during periods of governmental focus on innovation in the sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349103-us-house-crypto-bills-vote/