- Cantor Fitzgerald acquires 30,000 BTC, leading to significant market shifts.

- Cantor invests in crypto market depth and expansion.

- Strengthening Bitcoin’s role in institutional treasury strategies.

In a major transaction, Cantor Fitzgerald, under Brandon Lutnick’s leadership, will acquire 30,000 Bitcoin from Blockstream’s Adam Back. This acquisition positions Cantor Fitzgerald as a leading institutional Bitcoin holder, enhancing the trend of crypto in corporate treasury strategies, raising $4 billion for additional purchases.

Cantor Fitzgerald, through its SPAC Cantor Equity Partners 1, intends to acquire 30,000 BTC from Blockstream Capital’s founder, Adam Back. The deal involves raising up to $800 million in external capital, enhancing the overall transaction to exceed $4 billion in value. Cantor’s move will reportedly shift the focus towards Bitcoin investment, placing it among the largest institutional Bitcoin holders globally. Additionally, Blockstream Capital will receive shares in the renamed entity BSTR Holdings.

Market Impact of the Acquisition

There are expectations of significant impacts on Bitcoin’s market sentiment and liquidity due to the acquisition. This aligns with Cantor’s strategy to accelerate Bitcoin’s integration into traditional financial realms. Cryptocurrencies have seen increased interest as corporate reserves among global institutional players, with strong demand and reduced volatility potentially stabilizing Bitcoin’s price in the future.

While official statements are absent, the deal aligns with institutional strategies seen in recent years, reflecting broader acceptance of digital currencies. The transaction further highlights crypto’s role in treasury strategies, focusing on asset diversification beyond traditional equities.

“Brandon Lutnick, Chairman, Cantor Fitzgerald, is leading a $3.5–4 billion transaction involving 30,000 BTC in collaboration with Blockstream.” – Financial Times

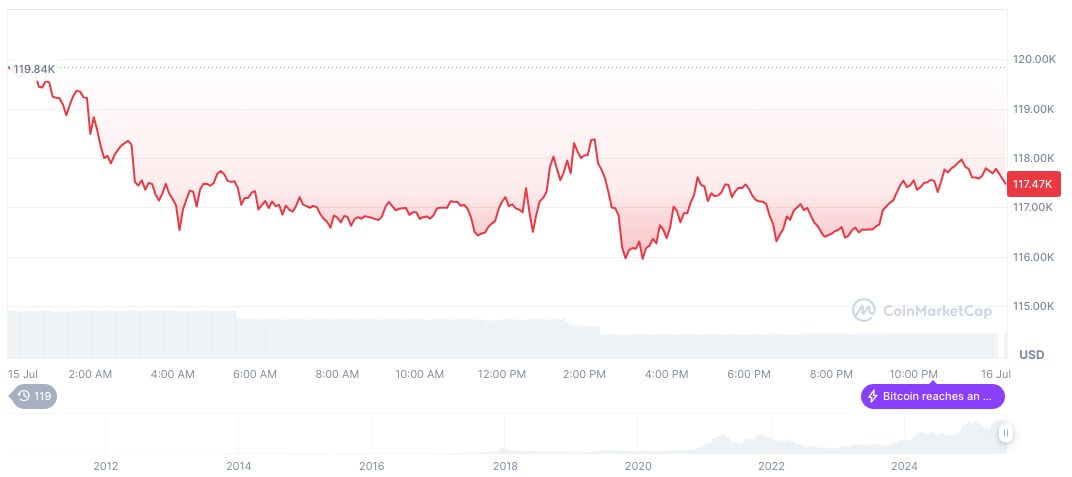

Current Market Data

Did you know? The acquisition by Cantor Fitzgerald, positioned after MicroStrategy’s large-scale accumulations, further cements Bitcoin’s place in corporate treasuries, marking a similar pivotal moment in institutional crypto commitments.

According to CoinMarketCap, Bitcoin currently trades at $118,490.35, with a market cap of 2.36 trillion dollars and a 62.75% dominance. It has a 24-hour trading volume of $75.65 billion, marking a 0.16% price change in the last 24 hours.

Insights from Coincu suggest the increased institutional involvement could boost Bitcoin’s adoption and regulatory framework adaptations, showcasing a shift towards mainstream financial integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349011-cantor-fitzgerald-bitcoin-blockstream/