- Trump eyeing Brainard for Fed chair amid ongoing discussions.

- Market reactions suggest interest rate changes loom.

- No direct impact on crypto assets confirmed yet.

U.S. President Donald Trump is considering Lael Brainard as a candidate for the Federal Reserve chair position, expressing satisfaction with her current role as Treasury Secretary, according to BlockBeats News on July 16th.

The potential replacement of Jerome Powell with Brainard raises speculation on shifts in U.S. monetary policy. Previous instances when Fed leadership speculated dovish tendencies led financial and crypto markets to adjust for possible rate cuts.

Trump, Fed Chair Shift, and Market Implications

Trump has publicly discussed replacing current Fed Chair Jerome Powell, citing a preference for more dovish monetary policy leadership. Brainard, previously Vice Chair of the Federal Reserve, is recognized for her regulatory expertise.

Speculation on a rate policy shift emerges as Trump favors Brainard, historically known for advocating regulatory measures. This aligns with investor expectations for potential interest rate reductions impacting market sentiment.

“I am actively considering replacing Jerome Powell, and Lael Brainard has been named as a candidate for the next Fed chair,” said Donald Trump, U.S. President.

Historical Impacts on Bitcoin and Financial Sectors

Did you know? When Fed leadership shifts hint at dovish policies, historical trends show an increase in risk asset rallies, bolstering cryptocurrencies like Bitcoin and Ethereum.

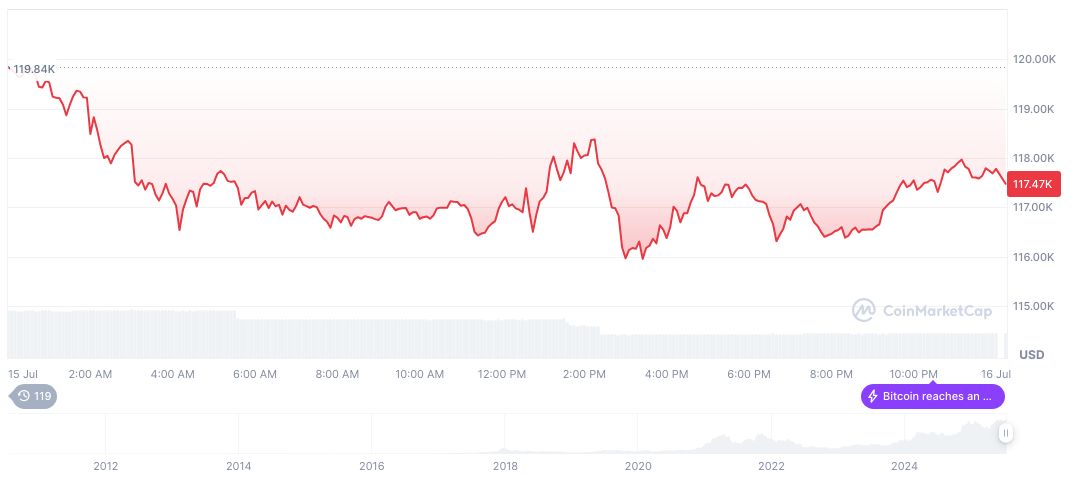

As of July 16, 2025, Bitcoin (BTC) trades at $117,515.72 with a market cap of $2.34 trillion, marking a 39.88% rise over 90 days. Its market dominance stands at 62.83%, per CoinMarketCap. The circulating supply is 19.89 million out of a max supply of 21 million.

Expert analysts highlight that potential changes in Fed leadership could impact fiscal and technology sectors. A dovish trajectory might encourage higher crypto investment, while regulatory outcomes could shape technology adoption among financial institutions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348886-trump-brainard-fed-chair-impact/