XLM price rally lost momentum in the past two consecutive days as the crypto market bull run faded. Stellar Lumens token plunged to a low of $0.4300 today, July 15, down by over 16% from the YTD high. This article explores why the XLM token may plunge by 40% in the coming days.

XLM Price Mean Reversion Could Trigger a 40% Crash

The daily timeframe shows that the XLM price went parabolic last week, hitting a high of $0.5145 as the crypto market rally intensified. This surge pushed it significantly higher than its recent moving averages, while oscillators such as the Stochastic and the Relative Strength Index (RSI) reached extremely overbought levels.

The main risk that the Stellar price faces is known as mean reversion. This refers to a situation where assets that have deviated so much from their moving averages move back close to them.

In XLM’s case, its current price of $0.45 is much higher than the 50-day and 100-day moving averages at $0.2900 and $0.2837, respectively. Therefore, the token may plunge by 40% to approach the two averages.

XLM formed a mean reversion in November last year when it surged by nearly 500% and deviated from its moving averages. It then dropped gradually until it closed that gap months later.

The other risk that the Stellar Lumens price faces is that it has deviated substantially from the upper side of the descending channel that connects the highest and lowest swings since December last year.

In most cases, an asset often retreats and retests the former resistance after it makes a strong breakout. This situation is known as a break-and-retest pattern, and is usually a highly bullish sign.

Therefore, the most likely scenario is where the XLM price drops by about 40% and then resumes the bullish trend. The bullish Stellar price forecast will be invalidated if it moves above the year-to-date high of $0.5155.

Stellar Open Interest Falling and Stablecoin Data Mixup

Another potential catalyst for the upcoming XLM price crash is that its stablecoin growth did not occur as most analysts had written about. DeFi Llama data shows that Stellar’s stablecoin supply surged to over $652 million last week, up from $170 million in May.

However, a closer look shows that the surge in stablecoin supply was not all that accurate. This growth occurred because the data aggregation platform simply moved the Franklin Onchain Money Market Fund, with its $441 million in assets, into Stellar’s stablecoin category.

Excluding the fund, Stellar’s network holds $185 million in stablecoins, with USDC accounting for $180 million and EURC having $1.92 million.

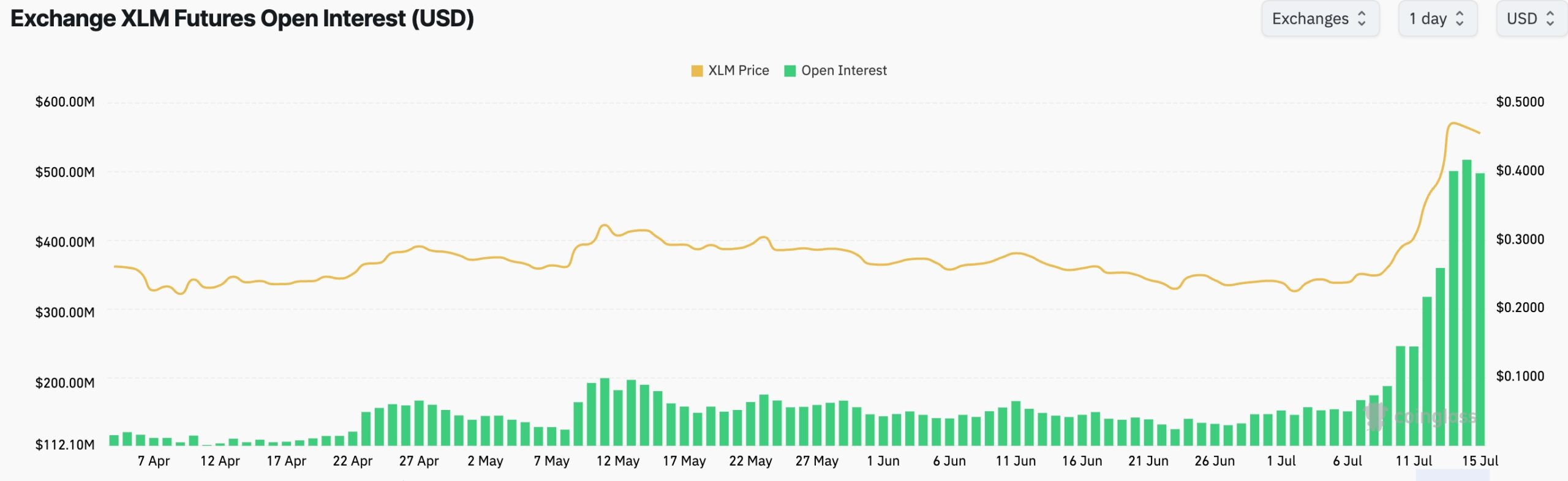

The stellar price may also plunge due to the falling futures open interest rate. CoinGlass data shows that the interest fell to $495 million on Tuesday from $520 million a day earlier. In most cases, crypto prices start declining when the open interest rate reaches its peak.

Summary

XLM price surged last week as the crypto market bull run gained steam. This rally could be about to end due to mean reversion and the fact that its futures open interest is declining.

Frequently Asked Questions (FAQs)

The most likely scenario is where the XLM price crashes by at least 40% to form mean reversion, and the fact that its stablecoin growth is not all that strong.

Yes, Stellar is widely seen as a good buy because of its utility in the payment and real-world asset tokenization industry.

No, the two are not the same. Stellar focuses on peer-to-peer payments, while Ripple focuses on institutional investors.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/markets/xlm-price-forecast-why-stellar-lumens-could-crash/