- Kevin Hassett questions the Federal Reserve’s approach to tariffs.

- Emphasized need for Fed policy independence.

- Federal Reserve’s next rate meeting is July 30.

Kevin Hassett, Chairman of the White House National Economic Council, has expressed concerns regarding the Federal Reserve’s stance on tariffs as of July 14th, while underscoring its need for independence.

Hassett’s remarks draw attention to the Fed’s challenges, hinting at impacts on economic policies. Speculation on his potential Fed leadership role remains unfounded.

Hassett’s Tariff Concerns Raise Federal Reserve Policy Issues

Kevin Hassett challenged the Federal Reserve’s handling of tariff issues, raising questions about its autonomy. He emphasized the broader implications of policy independence. Hassett did not confirm any interest in the Federal Reserve chair position during his recent statements.

Hassett suggested the Fed’s response to tariffs was “very wrong,” highlighting potential cost overruns. Jerome Powell, current Fed Chair, focuses on a data-driven approach, with key internal discussions suggesting divided views on future rate adjustments.

“While I can’t provide direct comments on the Fed’s operational strategies, the interaction between fiscal policy and monetary policy remains critical for economic stability.” — Kevin Hassett, Chairman of the White House National Economic Council

Market analysts note increased sensitivity around policy shifts, particularly related to interest rate decisions. Kevin Hassett’s comments add pressure on the Fed’s policy deliberations. The wider financial community continues monitoring for substantive changes ahead of the Fed’s key meeting later in July.

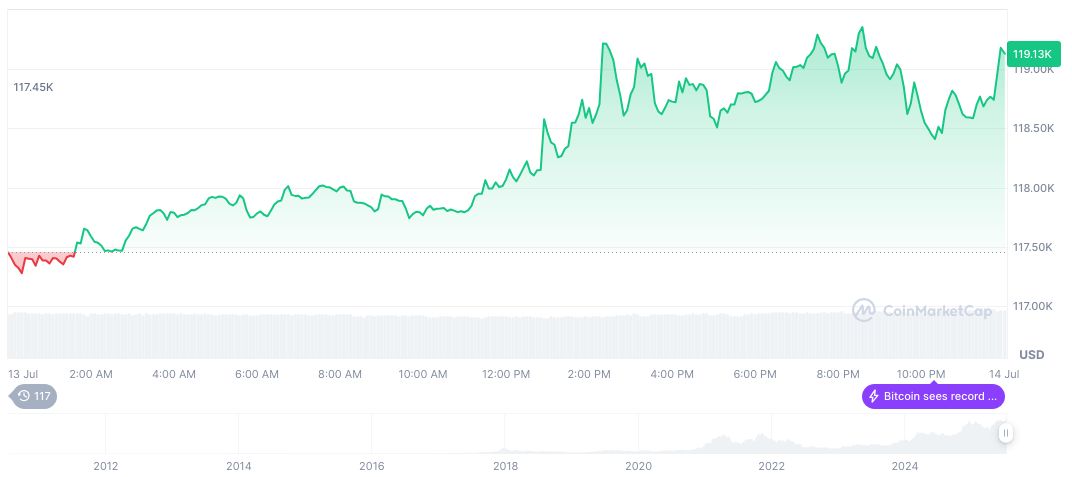

Bitcoin Surges as Fed’s Policy Moves Under Scrutiny

Did you know? In March and April 2020, the Federal Reserve aggressively cut rates to stimulate the economy during the pandemic, leading BTC and ETH to rally as dollar liquidity swelled.

CoinMarketCap reports Bitcoin’s current value at $121,731.88, with a market cap of approximately $2.422 trillion. Notably, BTC’s recent volatility highlights investor anticipation ahead of crucial Fed announcements, revealing potential shifts in trading strategies amid economic uncertainties.

The Coincu research team predicts that financial and regulatory responses will pivot based on upcoming Fed actions, namely, reactions to policy adjustments impacting market dynamics. Expectations of interest cuts in later months could fuel increased activity across crypto markets, aligning with historical responses to similar macroeconomic changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348590-hassett-tariff-federal-reserve-independence/