- Bitcoin’s reported $120,000 price peak lacks direct confirmation.

- Market implications include potential altcoin and DeFi gains.

- Analyst skepticism amid no official statements from key figures.

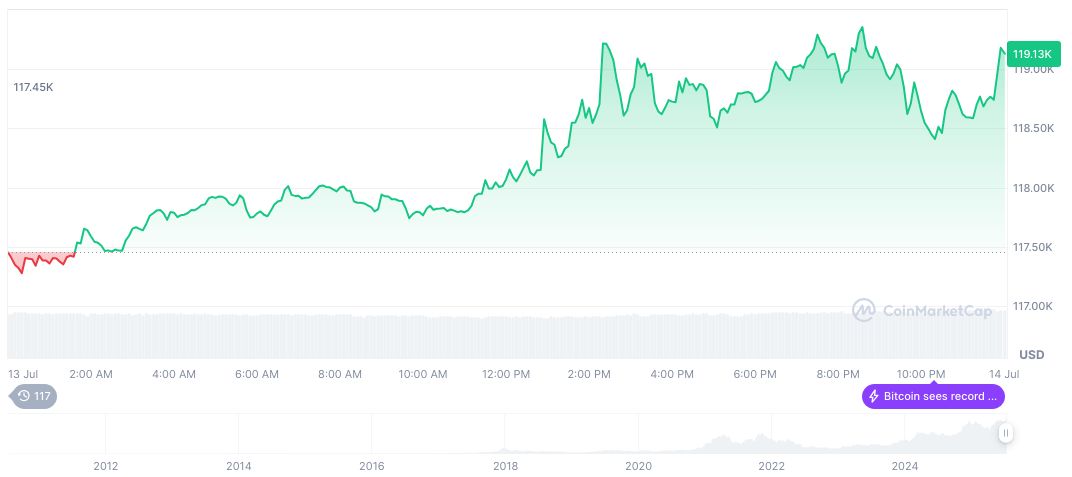

Bitcoin (BTC) is rumored to have reached a record price of $120,000 according to ChainCatcher, yet this lacks confirmation from exchanges or industry leaders.

The unverified claim, affecting market sentiment, lacked substantiation with key influencers like Zhao Changpeng remaining silent on major platforms.

Bitcoin’s $120,000 Claim Spurs Market Speculation and Doubt

Reports suggest BTC’s price surged to $120,000, evoking reflections on past highs. This claim was highlighted by ChainCatcher, though not supported by verifiable sources. Zhao Changpeng reportedly called this number trivial, but official confirmation is absent.

Markets speculate potential altcoin benefits, reflecting historical trends where Bitcoin’s significant rallies often lead to enhanced interest and trading across other crypto assets. While some investors monitor closely, verified price metrics remain crucial.

Absence of official statements from Zhao Changpeng or trading platforms raises questions. Industry commentators show restraint, emphasizing the need for validated data. This highlights ongoing scrutiny amid speculation-driven narratives.

“The blockchain industry thrives on transparency, creating both excitement and skepticism amongst traders,” observes a financial analyst, reflecting on the volatility of unverified reports.

Data Discrepancies Questioned as Bitcoin Leads Crypto Surge

Did you know? Amid past speculative spikes, Bitcoin’s $20,000 mark in 2017 spurred similar euphoric but cautious market reactions, showcasing repetitive patterns in crypto valuation surges.

Recent data from CoinMarketCap indicates Bitcoin’s price at $121,419.80 with a market cap of $2.42 trillion. Dominating 63.65% of the market, this reflects trading volume surges of 39.05%. Ongoing price increases confirm a 41.96% rise over 90 days, consistently impacting broader market dynamics.

Analysts from Coincu caution about optimism in the absent direct proof, suggesting market vigilance amidst evolving financial terrains. Past Bitcoin surges demonstrate potential cyclical impacts, reinforcing critical analysis of data integrity. Consistent market behavior often predicates future stability, marked by solid regulatory frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348531-bitcoin-price-unconfirmed-amid-rumors/