- Peter Schiff questions Bitcoin’s unit denomination and scarcity narrative.

- This critique has not swayed market prices or investor sentiment.

- Bitcoin’s fixed 21 million cap remains central to its value.

Peter Schiff, a notable economist and Bitcoin critic, recently questioned the understanding of Bitcoin’s scarcity on the social media platform X, prompting industry debate on July 12.

Schiff’s remarks scrutinize Bitcoin’s defining principle of programmed scarcity without directly affecting market dynamics or investor confidence.

Schiff’s Proposal to Measure Bitcoin in Satoshis

Schiff, CEO of Euro Pacific Capital, questioned Bitcoin’s unit definition by proposing a different measuring approach, asking if redefining a Bitcoin to 100,000 satoshis affects its perceived scarcity. His questioning was met with the finance community re-evaluating its scarcity claim, although the fixed supply of Bitcoin stands integral to its digital gold narrative.

Criticisms raised by Schiff echo long-standing debates within the crypto sector, yet they have not spurred any practical changes within Bitcoin’s technical protocol or policy frameworks. Bitcoin retains its status as a scarce asset, evident by its trading consistency with a 21 million BTC cap.

Community responses were strong, with Michael Saylor of MicroStrategy publicly reaffirming Bitcoin’s core scarcity by emphasizing its capped supply, regardless of unit division. “The beauty of Bitcoin is in its absolute scarcity. Whether measured in BTC or satoshis, the total supply is finite.”

Bitcoin’s Market Resilience Amid Critiques

Did you know? Bitcoin remains the leading cryptocurrency, with a market dominance of 63.87%, showcasing the enduring belief in its scarcity model.

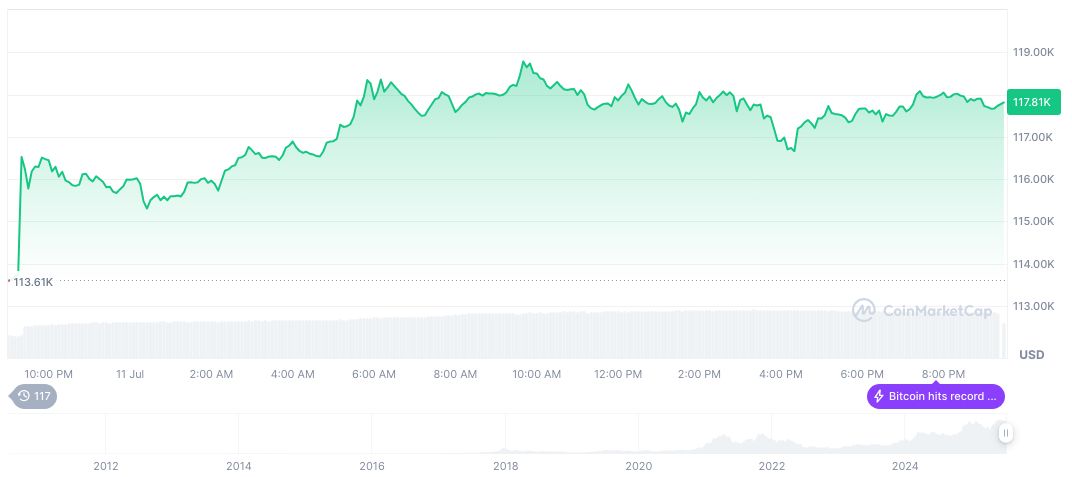

According to CoinMarketCap, Bitcoin trades at $117,366.42, with a market capitalization of $2.33 trillion as of July 12, 2025. It experiences a slight 0.23% decline within 24 hours; however, it shows an 8.44% gain over the past week. The cryptocurrency’s design of 21 million coins continues to resonate with investors.

The CoinCu Research Team highlights that, despite recurring critiques, the intrinsic value proposition of Bitcoin, driven by its in-built scarcity and divisibility, remains attractive. They forecast little regulatory or technological alteration to the Bitcoin supply model, keeping investor trust intact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348256-peter-schiff-bitcoin-scarcity-debate/