- Federal Reserve signals potential rate cuts, impacting inflation and markets.

- No rate cuts expected at the July meeting.

- Crypto markets may react to future policy shifts.

Jerome Powell, Chair of the Federal Reserve, has signalled that although interest rates will likely remain unchanged at the upcoming meeting, future cuts are a possibility if inflation improves or the labor market weakens.

The decision holds significant weight for financial markets, particularly as investors in risk assets such as cryptocurrencies remain alert to U.S. monetary policy cues.

Federal Reserve’s Outlook and Market Implications

Jerome Powell has indicated that the Federal Reserve will not cut interest rates at its upcoming meeting but may consider reductions later this year. This decision is strongly tied to future inflation data and labor market performance.

Despite current interest rates being maintained, the possibility of a future cut suggests an adaptive approach based on economic conditions. Inflation trends and employment rates will guide policy actions, as confirmed in the FOMC projections table with economic forecasts.

Financial experts like Nick Timiraos note the Fed’s current stance could influence bond yields and dollar stability. The crypto market historically shows volatility around such announcements, potentially affecting Bitcoin and Ethereum prices. “The possibility of rate cuts later in 2025 remains, but is conditional: If inflation data improves or the labor market weakens, cuts may proceed without ‘waiting for dramatic economic deterioration.’” — Nick Timiraos, Chief Economics Correspondent, The Wall Street Journal.

Potential Rate Cuts Could Boost Crypto Volatility

Did you know? The Federal Reserve’s historical approach often deviates from projections. Despite forecasts in June 2024, the Fed reduced interest rates by a full percentage point by September due to evolving economic data.

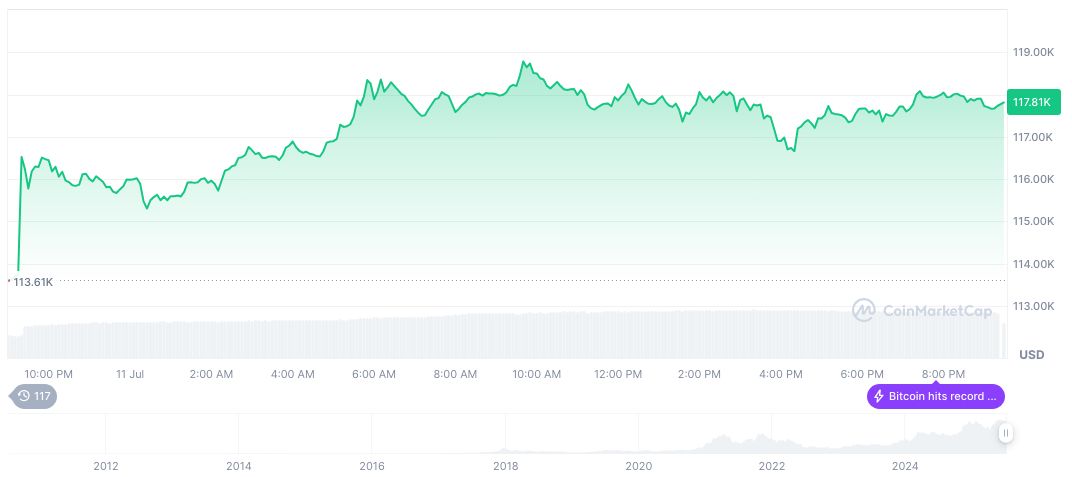

Bitcoin, currently priced at $117,753.23, exhibits recent growth patterns. The market cap stands at 2.34 trillion, with a 24-hour trading volume of 58.72 billion. Over 90 days, Bitcoin’s price surged by 39.73%, according to CoinMarketCap data.

The Coincu research team highlights that rate cuts could enhance crypto market liquidity and impact financial regulations. Historical analysis shows such policy shifts often precede increased crypto volatility and investor repositioning. For more insights, you can view the FOMC press conference transcript with key insights.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348250-fed-interest-rate-cuts-inflation/