- Glassnode reports Bitcoin small holders accumulate 19,300 BTC monthly.

- Miner output is 13,400 BTC/month.

- Significant supply tightening could affect Bitcoin prices.

Bitcoin wallets holding less than 100 BTC, often called “Bitcoin shrimps, crabs, and fish,” are accumulating Bitcoin rapidly, according to Glassnode’s analysis on July 12.

Small holders are purchasing Bitcoin at a rate of 19,300 BTC each month, contributing to market-wide supply constraints.

Small Holders Acquire More Bitcoin Than Miners Produce

Glassnode, a prominent on-chain analytics platform, reported that Bitcoin wallets, referred to as “Bitcoin shrimps, crabs, and fish,” are acquiring Bitcoin at a rate of 19,300 BTC/month. This activity is significant as it surpasses the mining output of only 13,400 BTC/month.

The accelerated accumulation by smaller holders is causing notable supply tightening in the Bitcoin market. This discrepancy poses implications for potential price shifts due to decreased available supply, which might create upward pressure on Bitcoin prices.

“Wallets holding fewer than 100 BTC, often referred to as ‘Bitcoin shrimp, crab, and fish,’ are rapidly accumulating Bitcoin at approximately 19,300 BTC per month, surpassing the mining output rate of 13,400 BTC per month. This points to the continuous net absorption of BTC by small holders contributing to a measurable supply constraint in the market.” — Glassnode Analytics Team, On-chain Analytics Platform, Glassnode.

In reaction to this trend, notable discourse on social platforms highlights heightened interest among retail investors and market analysts. Glassnode’s post generated widespread attention, although no major statements from leading figures have been publicized.

Historical Trends Suggest Positive Price Outlook

Did you know? In past Bitcoin halving events, small holder accumulation often preceded bullish market trends, tightening supply and supporting price increases over months. A similar pattern unfolds with current holder behavior.

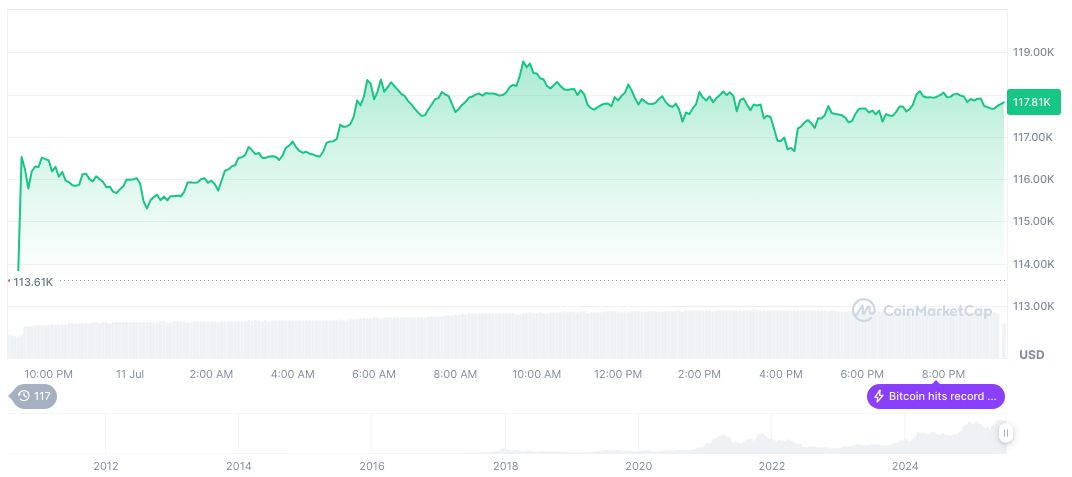

According to CoinMarketCap, Bitcoin (BTC) stands at $118,096.41, with a market cap of $2.35 trillion. It dominates the market with a 63.67% share. Trading volume in the last 24 hours reached $61.48 billion, showing a 49.79% decrease. BTC’s price decreased by 0.17% over 24 hours but increased by 39.71% over the past 90 days.

The Coincu research team suggests that ongoing accumulation by small holders may lead to notable shifts in BTC’s valuation. Historical data indicates parallels with previous uptrends, likely influencing future market sentiment as retail and non-institutional participation continues.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348238-bitcoin-small-holders-accumulation/