- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Two recent days with $1B+ inflows.

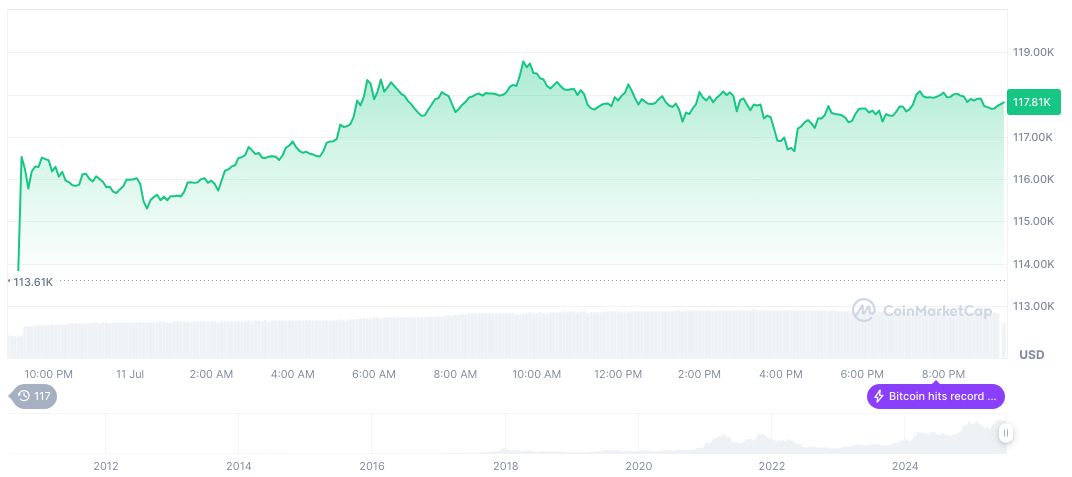

- Bitcoin price near all-time high.

Nate Geraci reported on July 12, 2025, that the US Bitcoin spot ETF witnessed significant inflows, with recent days surpassing $1 billion.

The surge in ETF inflows signals increased institutional interest, boosting Bitcoin’s market presence and price.

US Bitcoin ETFs Attract Over $1 Billion Inflows

Nate Geraci, President of The ETF Store, highlighted notable developments in the US Bitcoin spot ETF market. Recent reports indicate the ETF has seen significant inflows, exceeding $1 billion on seven days since its launch in January 2024. In the last two days, Geraci noted spikes in the inflow, emphasizing institutional appetite for Bitcoin.

This surge aligns with a broader trend of rising institutional investments in cryptocurrencies, significantly impacting Bitcoin’s price. Experts suggest this trend contributes to the cryptocurrency’s approach to an all-time high, underscoring a shift in institutional attitudes towards digital assets.

Nate Geraci, President, The ETF Store, – “Since the launch of US spot bitcoin ETFs in January, there have only been 7 days w/ $1B+ inflows. Two of those days happened in the past two days. Last $1B+ inflow was Jan 17 ($1.07B).” Source

The market responded positively to this influx of investments. Regulatory discussions and potential legislation, including the GENIUS Act, could further fuel interest in cryptocurrencies. Analysts view these ETF inflows as a barometer of institutional confidence, which remains robust despite broader market uncertainties.

Bitcoin’s Climb to $117,904 Spurs Institutional Interest

Did you know? Although Bitcoin ETFs are currently managed at just under $150 billion, this spike marks a significant turning point given it’s only part of the 5.1% of all Bitcoin in existence.

Bitcoin’s current valuation, according to CoinMarketCap, stands at $117,904.08 with a market cap of $2.35 trillion. The cryptocurrency witnessed a 39.37% increase over the past 90 days, holding a market dominance of 63.69%. Meanwhile, the BTC trading volume for the last 24 hours reached $73.20 billion. Its circulating supply currently sits at 19,891,225 BTC, approaching its max supply limit of 21 million.

Insights from the Coincu research team suggest that sustained ETF inflows alongside regulatory clarity could accelerate Bitcoin’s institutional adoption, potentially transforming the market landscape. However, some analysts caution that market volatility remains a critical factor, requiring careful navigation by investors and institutions alike.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348217-us-bitcoin-etf-inflows-market-surge/