- Coinbase sues Oregon Governor for transparency in crypto regulations.

- 31 digital assets categorized as securities without public discussion.

- Case highlights transparency challenges in state crypto regulations.

Coinbase has initiated legal action against Oregon’s Governor Tina Kotek, seeking the disclosure of public records tied to a rapid change in the state’s cryptocurrency regulations in April 2025. This policy adjustment categorizes 31 digital assets traded on Coinbase’s platform as securities, without public involvement.

This case spotlights the transparency challenges in state crypto regulations and affects hundreds of thousands in Oregon. Legal and market dynamics are crucial as similar regulatory issues arise nationwide.

Transparency and Governance at Stake Amid Legal Battle

Coinbase has filed a lawsuit against Oregon’s Governor demanding public access to records about the state’s policy shift on cryptocurrency regulations. This shift, applied without prior public discussion, now considers 31 digital assets on Coinbase as securities. Coinbase argues this impacts the trading activities of hundreds of thousands of users.

Changes resulting from this policy include constraints on cryptocurrency trading in Oregon without regulatory clarity or participation in the decision-making process. “Sunlight is the best disinfectant, and transparency is the hallmark of good governance,” said Ryan VanGrack, Vice President of Litigation at Coinbase, emphasizing the need for transparency in governance.

While Oregon State’s Attorney General Dan Rayfield initiated legal action, claiming the trading of specific digital assets constitutes unregulated securities transactions, Coinbase’s Chief Legal Officer Paul Grewal maintains confidence in their defense, labeling the case as meritless.

Market Data and Insights

Did you know? In 2015, New York’s BitLicense led to reduced accessibility of numerous digital assets, setting a precedent for state-level regulations affecting crypto markets.

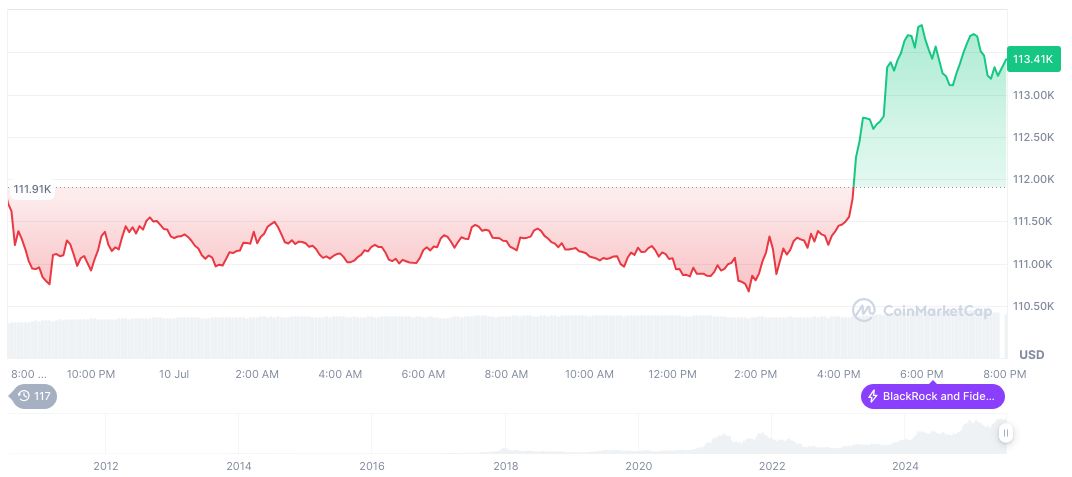

According to CoinMarketCap, Bitcoin (BTC) stands at $118,087.26, reflecting a 24-hour uptick of 4.06% with a seven-day increase of 10.04%. The market cap is at $2.35 trillion, holding a dominance of 63.50%. Recent volatility shows a 38.87% rise over 90 days.

Coincu’s research suggests that regulatory clarity could stabilize market conditions, especially if pending federal legislation aligns disparate state policies. History shows that transparent governance can reinforce market confidence and foster innovation in the crypto sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348137-coinbase-oregon-regulatory-lawsuit/