- Tether halts USDT support on five blockchains, shifting resources.

- Reflects strategy to enhance focus on active networks.

- No major market volatility expected from this change.

Tether, the issuer of USDT, plans to stop supporting its stablecoin on five traditional blockchains by September 1, 2025, as part of an infrastructure optimization strategy.

Tether has announced it will cease support for USDT on five blockchains, including Omni Layer and Bitcoin Cash SLP, by September 2025. This move is described as optimizing infrastructure to better serve actively developed networks. Paolo Ardoino, CEO of Tether, stated, “A broader effort to optimize infrastructure, align with community usage trends, and refocus resources toward high-utility, actively developed blockchains.” Tether.io, Official Announcement

Tether Ends USDT Support on Five Blockchains by 2025

This change affects a small portion of USDT’s total market, as Ethereum and Tron handle the majority of its volume. Users are encouraged to transfer their assets before the deadline. Liquidity on the impacted chains is expected to decrease to zero gradually.

The broader market response has been muted, with no major volatility anticipated for USDT prices. Leading crypto voices and regulators have yet to comment publicly, likely due to the minimal market share impacted by this decision.

Minimal Impact Expected as Market Reacts Calmly

Did you know? Tether previously removed USDT from low-activity blockchains without major market disruptions, a testament to the dominance of Ethereum and Tron in stablecoin issuance.

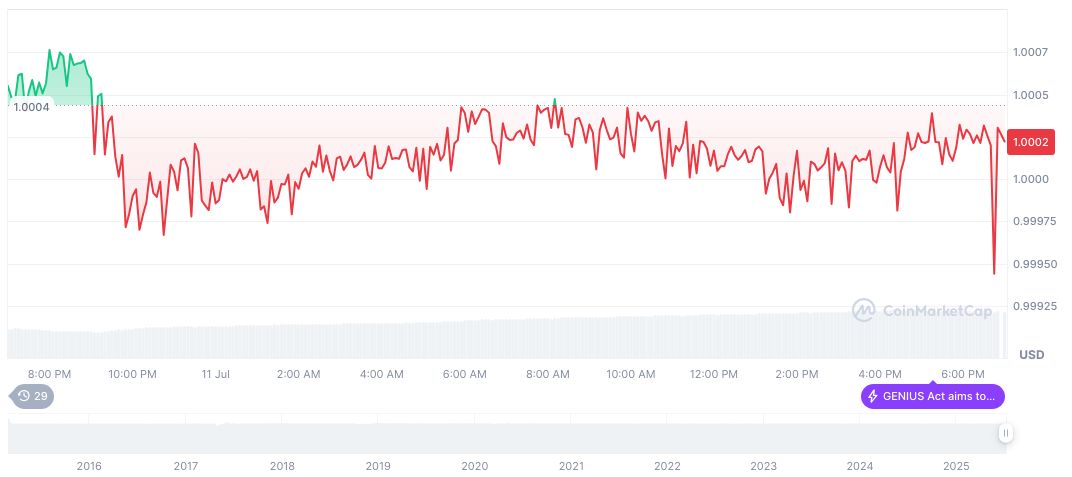

As of the latest update, Tether USDt maintains stability at $1.00, with a market cap of $159.12 billion and a 24-hour trading volume of $168.15 billion, according to CoinMarketCap. The stablecoin’s circulating supply is 159.09 billion. USDT’s price exhibited a minor 0.03% decline over the past 24 hours.

The Coincu research team projects minimal financial impact, largely attributed to USDT’s limited activity on affected chains. Historically, such transitions have not sparked significant regulatory responses, given their technical and backend nature. Continued focus on high-utility chains allows Tether to streamline its operations effectively. minimal financial impact

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348134-tether-drops-usdt-support-blockchains/