- Long-term holders show subdued euphoria levels.

- Market dynamics shift with increased whale activity.

- Institutional influence becomes more significant.

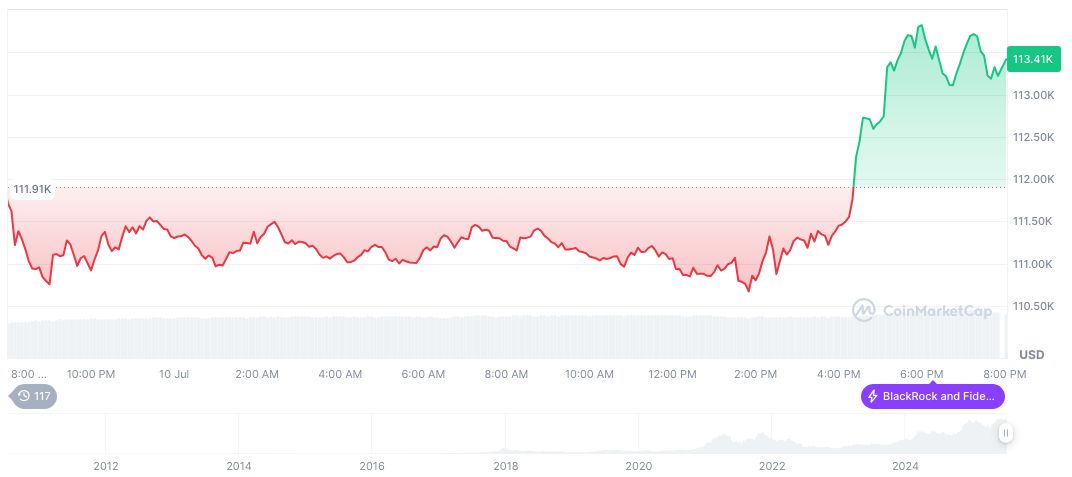

Bitcoin’s price reached new highs, but Glassnode data shows a lack of euphoria among long-term holders, with the NUPL at 0.69.

Despite high prices, fewer profits are realized by long-term holders, contrasting previous cycles with prolonged euphoria periods.

Long-Term Holders’ Euphoria Levels Markedly Low

Glassnode’s recent analysis reveals Bitcoin’s Long-Term Holder Net Unrealized Profit/Loss (NUPL) indicator remains below the euphoria zone. The indicator recorded at 0.69 after Bitcoin surged past $11.8k. This reading contrasts sharply with the previous cycle, which saw prolonged periods beyond the 0.75 threshold.

Current market dynamics indicate a notable shift: retail investors are reducing their BTC holdings while whales accumulate at high levels. As Rafael Schultze-Kraft, Co-Founder & CTO of Glassnode, noted, Retail BTC holders are reducing their positions, while whale addresses holding 1,000 to 10,000 BTC are accumulating. This pattern suggests increased caution among smaller investors, whereas larger entities increase their market exposure.

Market participants exhibit mixed reactions. Spot and futures trading volumes have declined, and options’ implied volatility remains low, suggesting a seasonal lull. Glassnode analysts continue to emphasize a shift in sentiment toward more cautious strategies among many traders.

Institutional Influence Grows as Retail Pulls Back

Did you know? Although Bitcoin’s price reached unprecedented levels, the current cycle only saw 30 days above euphoria, while the previous cycle experienced 228 days, highlighting cautious investor sentiment.

Bitcoin’s current price sits at $117,402.64, as reported by CoinMarketCap. The market cap has reached 2.34 trillion, and 24-hour trading volume saw a significant increase by 83.11%. Over the last 90 days, Bitcoin’s price surged by 38.24%.

Insights from Coincu suggest the market is entering a stage where institutional players show significant influence. Continued accumulation by whales and lower retail activity indicate potential for a shift toward more institutionally driven market momentum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348131-bitcoin-long-term-holders-caution/