- BlackRock’s iShares Bitcoin Trust becomes the fastest ETF to surpass $80 billion.

- Achieved in 374 days, outpacing Vanguard’s VOO by a wide margin.

- Sets a precedent for institutional crypto adoption and BTC market influence.

BlackRock’s Bitcoin Trust Surpasses $80 Billion in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) achieved a milestone on July 11 by surpassing $80 billion in assets under management in just 374 days, as reported by PANews. The global asset manager’s ETF has now reached a market value of $83 billion.

Market Reactions and Potential Regulatory Impacts

BlackRock’s iShares Bitcoin Trust reaching $83 billion in value highlights a profound shift in asset management. The trust is managed by BlackRock, a leader in sector investments, and focuses on Bitcoin as its underlying asset. The ETF shattered previous records, demonstrating significant institutional demand, as reported by ETF analyst Eric Balchunas.

The accelerated growth signifies increased market interest and legitimization of cryptocurrencies within traditional financial structures. This milestone may prompt other asset managers to pursue similar offerings, potentially transforming the landscape of crypto investments and integration.

The cryptocurrency community has expressed enthusiasm about the endorsement and development of Bitcoin-focused funds.

Historical Context, Price Data, and Expert Insights

Did you know? The record-breaking growth of BlackRock’s iShares Bitcoin Trust in 374 days occurs amid the latest Bitcoin bull run, highlighting an evolving institutional trust in cryptocurrency investments.

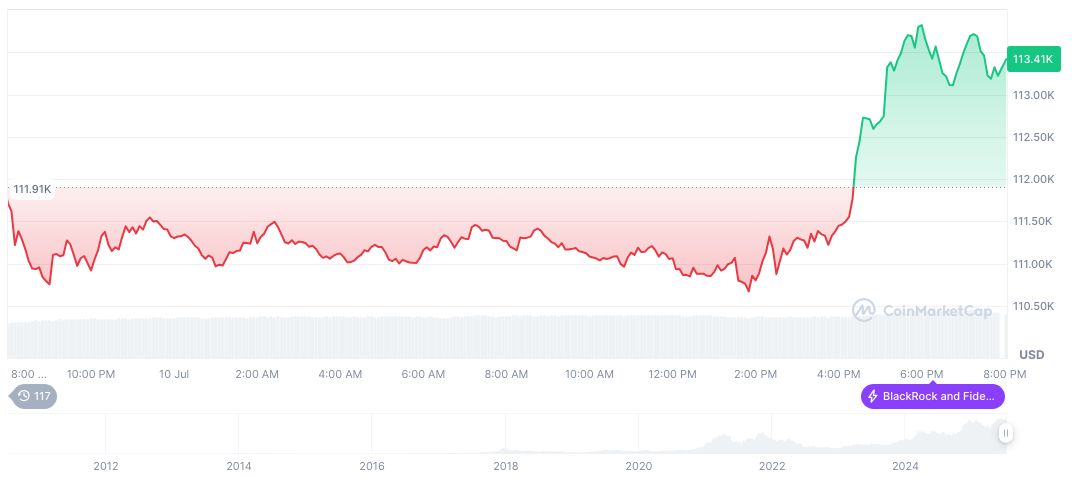

Bitcoin (BTC) maintains a strong market position with a price of $118,059.99, according to CoinMarketCap. Its market cap has reached approximately 2.35 trillion, with a market dominance of 63.76%. The trading volume over the last 24 hours saw an increase of 113.62%, indicating active market dynamics and attention toward Bitcoin as a key asset.

The Coincu research team suggests this achievement will likely drive regulatory clarity around ETFs focused on digital assets, advancing financial innovations. Historical trends in ETF adoption showcase consistent expansion, with regulatory approval possibly accelerating broader cryptocurrency advancements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348087-blackrock-bitcoin-trust-reaches-83-billion/