- MicroCloud Hologram’s $200M Bitcoin investment; tech innovation and strategic shifts.

- Supports blockchain, AI-AR, quantum computing investment strategy.

- Strengthens institutional interest in cryptocurrency markets.

MicroCloud Hologram Inc., a Nasdaq-listed firm, announced on July 11, 2025, its plan to invest up to $200 million in Bitcoin and cryptocurrency derivatives, aiming to deepen exposure into digital assets.

This strategic move underscores a growing trend of integrating digital assets into corporate treasury strategies, spurring institutional interest in cryptocurrencies.

MicroCloud’s $200M Digital Asset Strategy Explained

MicroCloud Hologram Inc. has decided to utilize about $200 million for Bitcoin and cryptocurrency-related derivatives, as officially stated. Aiming to diversify its asset base, the company views this initiative as a transformative strategy in adapting to evolving financial landscapes. This forms part of a broader strategy, leveraging its cash reserves of approximately $394 million to support blockchain technology, AI-AR, and quantum computing.

The immediate effects of these investments highlight increased visibility for institutional stakeholders considering crypto as a viable reserve asset. Aligning with leading companies, such actions reflect risk management strategies recognizing digital currencies’ evolving prominence. MicroCloud joins visible companies holding substantial Bitcoin reserves, reaffirming cryptocurrency’s role in modern finance. The company emphasizes its investment in market insights and investment strategies through this decision.

“The purchased Bitcoin and its derivatives this time will be incorporated into HOLO’s capital reserve strategy, aiming to enhance the company’s financial stability and long-term growth potential through diversified investments.” – MicroCloud Hologram Press Release

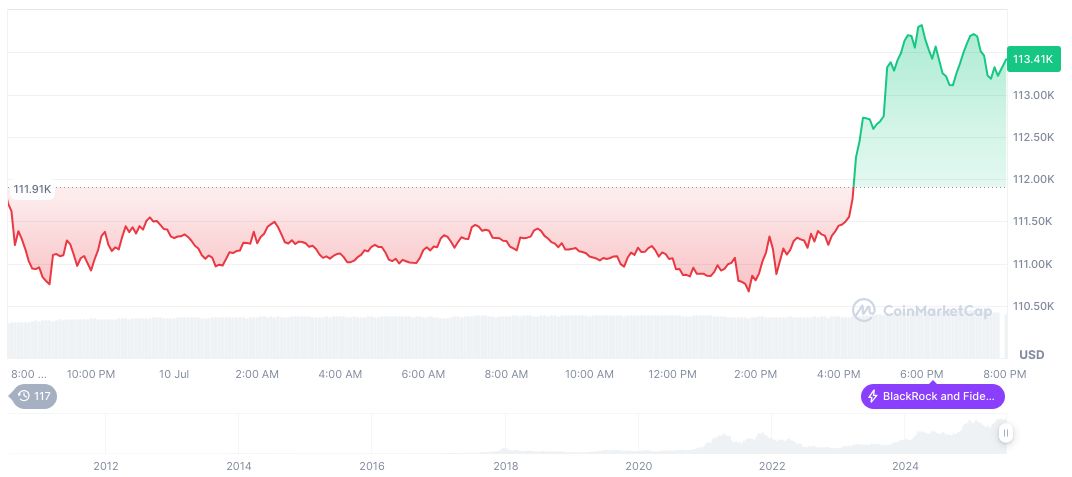

Bitcoin Price Surges Amid Institutional Adoption

Did you know? In previous cases, such as with MicroStrategy’s investments, large corporate allocations into Bitcoin have often led to price rallies, demonstrating institutional recognition of crypto as strategic reserves.

Bitcoin (BTC) is priced at $117,762.87, exhibiting notable 90-day gains of 40.68%, underpinning robust demand. It commands a $2.34 trillion market cap, with 63.78% market dominance and a trading volume exceeding $124.41 billion. These data, collated by CoinMarketCap on July 11, 2025, highlight a resilient price trajectory and substantial investor engagement.

Coincu research indicates that regulatory changes could spur further institutional adoption. Technological integration of blockchain enhances operational efficiency, contributing to broader acceptance. Historical trends suggest a consistent relationship between major company announcements and market responses, potentially motivating increased investment activity. Companies integrating crypto into their financial planning signal mainstream acceptance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348070-microcloud-bitcoin-crypto-investment/