- Over $1.24 billion in crypto liquidations, short positions affected most.

- $1.114 billion short liquidations, impacting Bitcoin and Ethereum.

- Crypto market shifts reflect potential volatility in altcoins.

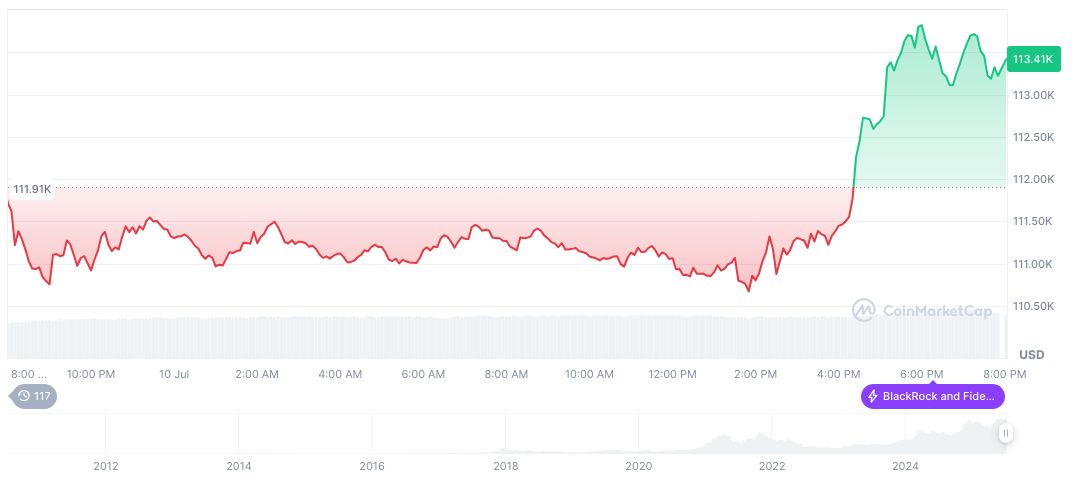

On July 11, data from Coinglass revealed that the crypto market witnessed a $1.24 billion liquidation mainly in short positions, with Binance and Bybit playing key roles. The liquidation event signifies a possible market reversal with crypto assets like Bitcoin and Ethereum experiencing forced buying pressure, impacting future price stability.

According to Coinglass, “Total liquidations reached $1.24 billion over the past 24 hours, with short liquidations amounting to $1.114 billion, indicating a significant market-wide short squeeze.”

Forced Buy-Ins Lead to Market Volatility and Potential Regulation

In the past 24 hours, the crypto market saw $1.24 billion liquidated, with the majority—$1.114 billion—from short positions. Coinglass provided this data, highlighting the involvement of major centralized exchanges such as Binance and Bybit. Long positions accounted for just $126 million.

Immediate implications include potential price increases for Bitcoin (BTC) and Ethereum (ETH) as short positions are forced to cover their buys. This event mirrors historical short squeezes, where asset prices climb sharply. The dominance of short liquidations underscores the evolving market conditions.

Market reactions remain speculative, with no major statements from prominent industry figures or government officials. Discussions in crypto forums suggest this could signify a market turnaround. Key industry leaders remain silent on specific impacts, leaving room for investor interpretation.

Market Data and Future Insights

Did you know? During past short squeezes, altcoin volatility often amplified, affecting market liquidity dramatically.

As of July 11, 2025, Bitcoin’s price reached $117,887.49, creating a market cap of $2.34 trillion. Bitcoin controls 63.64% of total market dominance, with a 24-hour trading volume of $108.33 billion, reflecting an 82.05% increase according to CoinMarketCap. Over 90 days, Bitcoin’s price increased by 41.47%, signaling robust market dynamics.

Coincu research highlights potential financial market adjustments due to forced buy-ins from short positions. Regulatory interventions might arise if liquidations persist, affecting trading strategies on exchanges and possibly leading to enhanced transparency measures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348009-crypto-market-1-24-billion-liquidation/