- Loretta J. Mester raises concerns over U.S. fiscal deficit.

- Increased market risks due to fiscal instability.

- Bitcoin sees significant gains as a hedge in volatile times.

Loretta J. Mester from the Federal Reserve Bank of Cleveland raised concerns about the U.S. fiscal deficit’s unsustainable direction during remarks on July 10, 2025. Her comments underline potential financial stability challenges.

Her warning is particularly significant against the backdrop of an FY2024 deficit of 6.4 percent of GDP, posing risks to fiscal and monetary policy balance that may sway market dynamics.

Mester Flags $1.83 Trillion Deficit as Market Risk

Mester highlighted the growing U.S. fiscal deficit as an escalating risk, emphasizing it might impact financial stability. She has consistently underscored fiscal discipline’s importance, given current deficit levels. “The U.S. fiscal deficit is on an unsustainable path and could pose a financial stability risk in the future,” Mester remarked, highlighting the deficit’s pressure on interest rates due to higher borrowing costs.

Rising deficits also have broader economic implications. Treasuries and borrowing costs could climb, affecting liquidity and private investment. Such fiscal issues resonate with past economic events, underscoring the potential for currency devaluation and bond market reactions, especially if concerns over U.S. debt sustainability grow.

Industry observers are monitoring responses from the market and policymakers. As creditors and central banks weigh these developments, investor strategy may shift toward safe assets like Bitcoin and gold, reflecting historical responses to U.S. fiscal instability.

Bitcoin Gains 35.76% Amid Fiscal Concerns

Did you know? In 2011, during U.S. debt ceiling debates, similar fiscal fears catalyzed a notable surge in Bitcoin adoption as a hedge against traditional asset volatility, an effect still relevant in today’s fiscal discourse.

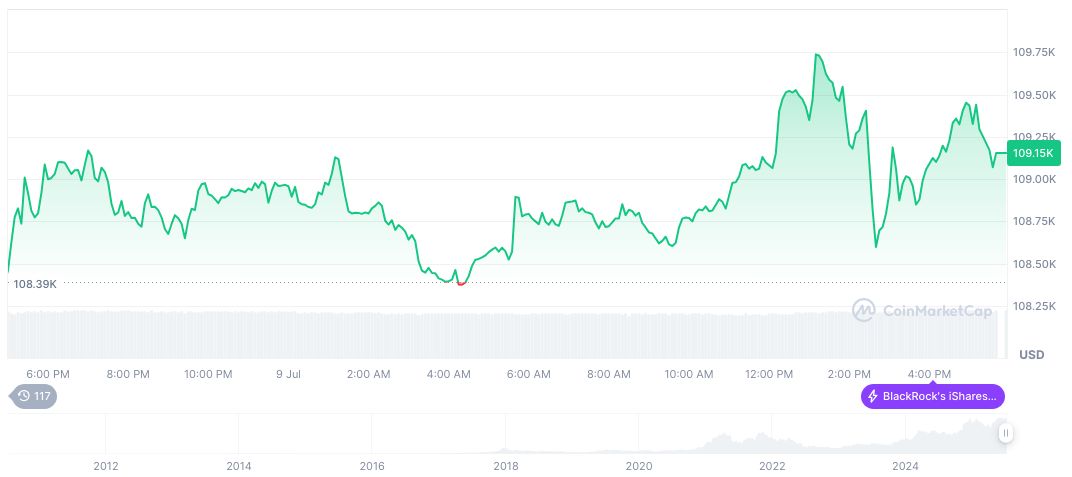

Bitcoin (BTC) continues to demonstrate resilience, trading at $111,307.71 and holding a market cap of $2.21 trillion, as per CoinMarketCap. The cryptocurrency shows a 2.19% increase in 24 hours, with a significant 35.76% rise in 90 days, reflecting its robustness amid fiscal instability concerns.

The Coincu research team notes that warnings like Mester’s often lead to increased demand for decentralized financial assets as potential hedges. Monitoring fiscal policy shifts can guide strategic asset allocation, as historical patterns suggest volatility ahead in traditional and digital markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347898-fed-mester-warns-us-fiscal-deficit/