- Ant Group intends to integrate Circle’s USDC stablecoin globally.

- Focus on global payments through regulatory compliance.

- Potential market shifts expected with stablecoin integration.

Ant International, the global business unit of Ant Group, plans to incorporate Circle’s USDC stablecoin into their platform globally, as reported by market sources on July 10.

This integration aligns with Ant’s strategy of enhancing efficient global payments rather than speculating in cryptocurrency markets, according to Kelvin Li’s statements.

Ant Group Poised for Global USDC Integration

Ant Group, a major player in financial technology, is set to integrate Circle’s USDC stablecoin when compliance is achieved. Kelvin Li, Head of Platform Tech, emphasized the focus on global payments rather than cryptocurrency speculation at a Singapore conference. As Kelvin Li stated, “Firstly, we will not be focusing on crypto transactions. On the other side, we’ll be focusing on global payments. We believe stablecoins are an important means that will enable us to provide global payments in [a] much more efficient way and bring much better customer experience.” As the USDC’s regulatory compliance process continues, no definitive timeline for integration exists. However, anticipation is high for both the financial industry and crypto enthusiasts, particularly those in the payments sector. Jeremy Allaire, CEO of Circle, outlined the advantages of regulated stablecoins, stressing their role in addressing pain points in global payments.

Ant Group’s application for a stablecoin license under Hong Kong’s new regime suggests it is expanding compliance efforts. Collaborative initiatives such as the partnership with Deutsche Bank for incorporating tokenized deposits show Ant’s intent on enhancing payment innovations. Market reactions have been generally supportive, with no significant negative feedback or protests from governmental bodies. Observers expect future addressations of compliance challenges as the process progresses.

Did you know? Ant’s integration of USDC may mirror PayPal’s stablecoin launch, impacting stablecoin liquidity significantly, similarly seen in previous cross-border payment sector expansions.

USDC’s Market Influence and Industry Insights

Did you know? Ant’s integration of USDC may mirror PayPal’s stablecoin launch, impacting stablecoin liquidity significantly, similarly seen in previous cross-border payment sector expansions.

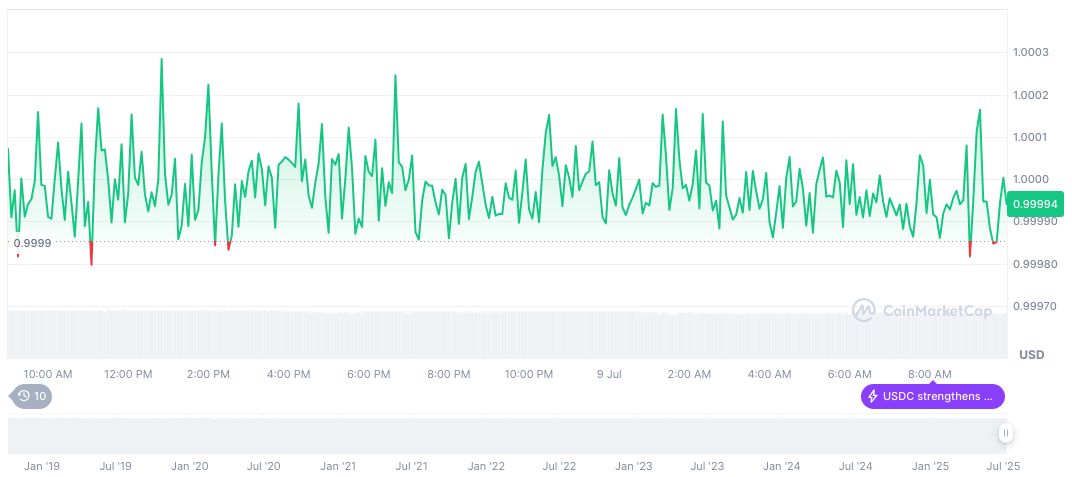

USDC, currently priced at $1.00, maintains a market cap of $62.57 billion (1.80% market dominance), with a 24-hour trading volume of $12.32 billion, according to CoinMarketCap. The stablecoin’s market activity increased by 49.75% in the last day, indicating potential forthcoming market shifts as integration prospects advance.

Coincu’s research team notes that such integrations, like Ant International’s, may lead to increased use of USDC on-chain. This could bolster cross-border liquidity and spur broader adoption of stablecoin solutions, aligning well with growing trends in financial technology platforms seeking regulatory stability and enhanced payment infrastructures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347840-ant-group-usdc-integration-plan/