- Ripple CEO to testify before U.S. Senate on crypto legislation.

- Focus on GENIUS Stablecoin and CLARITY Market Structure Acts.

- Potential impact on regulatory oversight between SEC and CFTC.

Ripple CEO Brad Garlinghouse will testify at the U.S. Senate Banking Committee on July 9, addressing regulatory clarity for digital asset markets.

The hearing is part of a legislative push to define regulatory oversight. Market impacts are anticipated following the testimony.

Garlinghouse’s Testimony to Address GENIUS and CLARITY Acts

Brad Garlinghouse, CEO of Ripple, announced his upcoming testimony at the U.S. Senate Banking Committee. The hearing, titled “From Wall Street to Web3,” will focus on the “GENIUS Stablecoin Act” and “CLARITY Market Structure Act,” both integral to clarifying the regulatory division between the SEC and CFTC. The hearing will be livestreamed as part of the Senate Digital Assets Subcommittee’s efforts.

Regulatory clarity could transform the crypto landscape by establishing guidelines for the SEC and CFTC. The outcome may determine which tokens these agencies regulate, significantly impacting major cryptocurrencies and stablecoins. Analysts suggest that clear regulation may stimulate market growth by attracting institutional investors cautious about regulatory compliance.

“It’s critical for the U.S. to establish constructive crypto market structure legislation to unlock the next era of financial innovation and opportunity—while protecting consumers.” — Brad Garlinghouse, CEO, Ripple

Players from both the U.S. cryptocurrency industry and regulatory bodies anticipate significant implications. Garlinghouse emphasized the importance of legislative clarity in a statement, urging the government to establish constructive market structure to facilitate financial innovation while safeguarding consumers. Community reactions remain mixed, with some entities expressing concern over potential compliance burdens.

Historical Impacts of U.S. Crypto Regulations

Did you know? The U.S. regulatory landscape has significantly influenced global crypto movements. For instance, the 2021 SEC v. Ripple case prompted major exchanges to delist Ripple’s XRP.

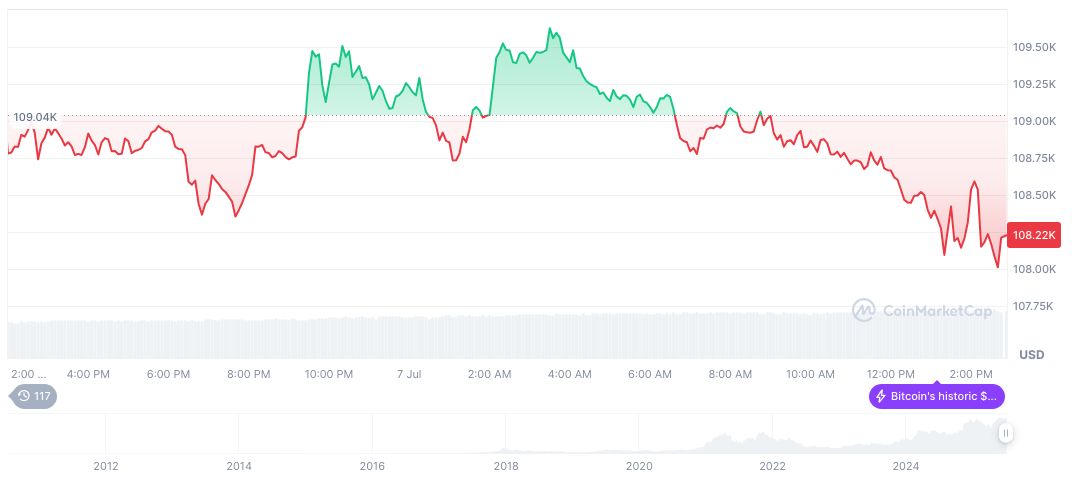

Bitcoin (BTC) currently trades at $108,926.10, with a market cap of $2.17 trillion, dominating 64.4% of the market, according to CoinMarketCap. In the past 24 hours, BTC’s trading volume hit $45.57 billion, marking a 12.62% increase. Over 90 days, BTC noted a dramatic 42.60% rise.

Experts from Coincu highlight that the proposed legislative measures could encourage financial innovation while reducing legal ambiguities for investors. Historically, similar regulatory discussions have prompted market volatility but eventually led to more mature, robust market environments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347476-ripple-ceo-us-senate-hearing/